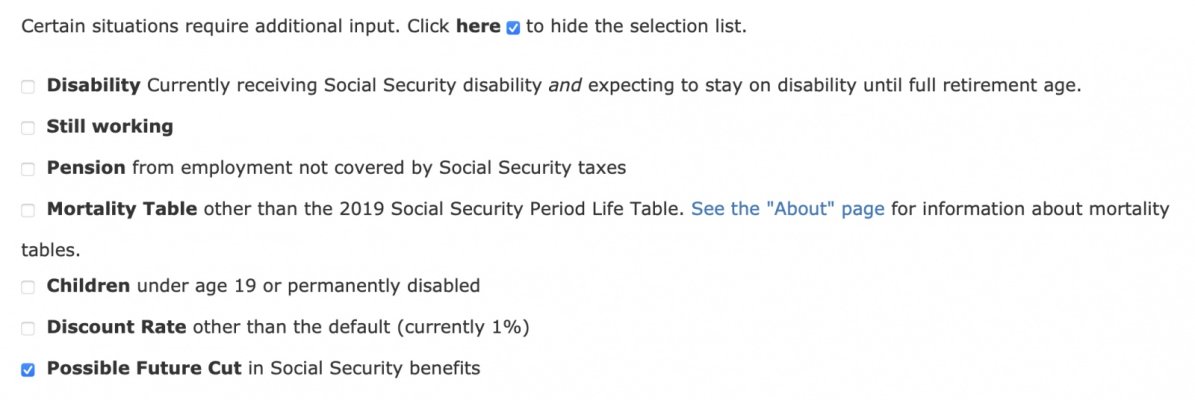

Don't overlook the additional input options when using OSS. We know our mortality doesn't match the default, and that option can make a huge difference WRT claiming age - plus or minus. If you expect greater than average longevity, or shorter than average, it will affect the results - mortality is where you account for that if needed.

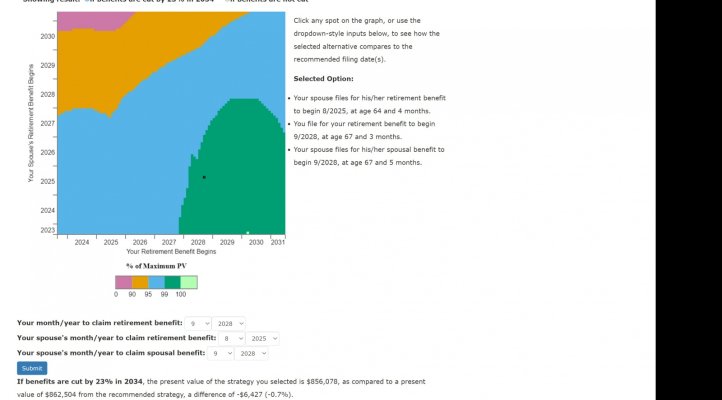

Yes, good point. If I set age of death to 89, filing at 70 is recommended. Anything lower than 89 I should file earlier.

Longevity is not great in my family, but I hope to beat the odds. But even if I get lucky, 89 would be impressive.