street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,565

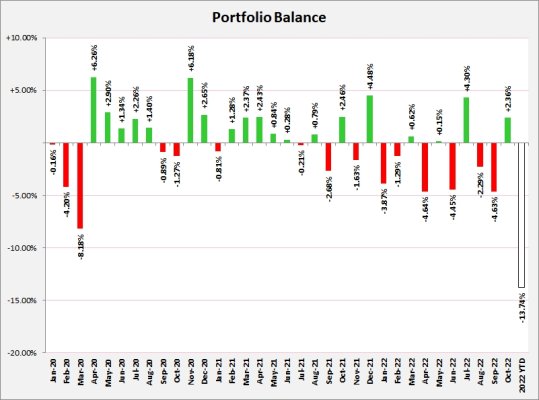

We will never understand why people look at monthly and yearly returns. I compare results to my Financial Plan to age 100. Doing fine so far. Substantially ahead of plan! A couple of setbacks but nothing to put us off our plan.

If we enter a bear market, it might get bad but these reversals are just noise!

I would say not looking monthly or yearly wouldn't be good business. A lack of responsibility when managing millions of dollars.

I want to know where I have been and where things are going. Not for entertainment purposes either just good business.

110122 >> -15.88.