You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AAPL stock - long term opinions

- Thread starter MichealKnight

- Start date

I don't know what to say...closed at almost $134.18 today (536.72, pre-split). It is now a way outsized portion of my portfolio (as far as how much of of one's portfolio should be in one stock). Any rationale part my brain is drowned out by the greedier part, LOL. We haven't even got to the new phone releases coming up...

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't know what to say...closed at almost $134.18 today (536.72, pre-split). It is now a way outsized portion of my portfolio (as far as how much of of one's portfolio should be in one stock). Any rationale part my brain is drowned out by the greedier part, LOL. We haven't even got to the new phone releases coming up...

Between Apple, Amazon and Chipotle, I’ve gained $48,000 since Aug 21 when I decided to buy back part of some stocks I sold because of the previous big run up.

explanade

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 10, 2008

- Messages

- 7,449

I don't know what to say...closed at almost $134.18 today (536.72, pre-split). It is now a way outsized portion of my portfolio (as far as how much of of one's portfolio should be in one stock). Any rationale part my brain is drowned out by the greedier part, LOL. We haven't even got to the new phone releases coming up...

AAPL shareholders have to pay it back, buy up iPhone 12s, Apple Watch Series 6, etc.

New iPads too!

Cha-Ching!

Blueskies123

Recycles dryer sheets

I tend to be numbers focused. As a 2t company it is about 40x current annual earnings rate. Not outrageous. But there is one big problem.

How much can a 2t company grow?

Assuming the company holds the same margins it has to double sales to get to 20x PE

.

Not outrageous? Me thinks it is.

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

RetireBy90

Thinks s/he gets paid by the post

I tend to be numbers focused. As a 2t company it is about 40x current annual earnings rate. Not outrageous. But there is one big problem.

How much can a 2t company grow?

Assuming the company holds the same margins it has to double sales to get to 20x PE

I agree that they need to REALLY grow revenue and PE of 40 is out of my comfort zone. That said, after selling out before the split I got back in at $125, just 100 shares, but would consider buying more if there is a pullback of say 25-30%. At a PE of 30 still expensive but it is growing and these things can continue much longer than I ever think. I'll put in a stop loss at some point so I don't have to watch so close and can lock in some more gains.

Who knows, they may get into grocery business or into takeout delivery on the new iDrone.

Asabino

Dryer sheet aficionado

I had AAPL since the late 1990's. When they came out with the ipod and iphone and when my kids hounded me to buy them one- I knew the company would be ultra successful.

Bought and sold. I've gone thru the stock splits as well. Frankly, I love the products and I love the stock. AAPL paid for my daughter's undergrad and medical school tuition. And now, AAPL is still my largest holding. If I lose 50 percent of my gains, I'm still way ahead. Until I see and hear sigificant hurdles and head winds, I'll probably hold them for the foreseeable future.

Bought and sold. I've gone thru the stock splits as well. Frankly, I love the products and I love the stock. AAPL paid for my daughter's undergrad and medical school tuition. And now, AAPL is still my largest holding. If I lose 50 percent of my gains, I'm still way ahead. Until I see and hear sigificant hurdles and head winds, I'll probably hold them for the foreseeable future.

Badger

Thinks s/he gets paid by the post

- Joined

- Nov 2, 2008

- Messages

- 3,424

We inherited AAPL shares a few years ago. It has increased considerably since that time. Too much to cash in and not have to pay considerable taxes. So we won't be selling or buying any and will leave it to the kids when they can start with a new basis. I will never know the rationale of why they chose to split at this time but it doesn't make me comfortable.

Cheers!

Cheers!

Last edited:

I will never know the rationale of why they chose to split at this time but it doesn't make me comfortable.

Cheers!

I have heard more than one investor say this? Why so?

BeachOrCity

Full time employment: Posting here.

- Joined

- Jun 1, 2016

- Messages

- 892

OF COURSE appl results are great this year. All around the world people have needed to beef up their home technology for remote work.

When will that effect fall off and will it result in sales declines as people don’t need to upgrade bc they refreshed everything during Covid?

When will that effect fall off and will it result in sales declines as people don’t need to upgrade bc they refreshed everything during Covid?

thepalmersinking

Recycles dryer sheets

- Joined

- Mar 29, 2015

- Messages

- 180

AAPL created and owns the ecosystem. It’s not just a hardware company. When companies are suing you to gain access to your ecosystem then that should tell you something. Cash on hand is off the charts. Maybe a bit over their skis on PE, for now.

conversationalphrase

Recycles dryer sheets

- Joined

- Jan 8, 2017

- Messages

- 264

AAPL kills it again. It will be interesting to see how this market responds today.

https://www.cnbc.com/2022/01/27/apple-aapl-earnings-q1-2022.html

https://www.cnbc.com/2022/01/27/apple-aapl-earnings-q1-2022.html

BeachOrCity

Full time employment: Posting here.

- Joined

- Jun 1, 2016

- Messages

- 892

AAPL kills it again. It will be interesting to see how this market responds today.

https://www.cnbc.com/2022/01/27/apple-aapl-earnings-q1-2022.html

The forward earnings yield is 4%. the peg ratio is 1.8

Its a fantastic company, but IMHO the earnings growth rate does not support the current pricing.

All that said, I have much more of a value tilt, which has not served me well for the past 10 years.

Chart out another great company. MSFT. Dead money for over a decade, but the whole time was a fantastic company. Only when the reinvented themselves, did the stock take off again. Being able to do what MSFT did is the exception, not the rule.

Pre marlet AAPL is up almost 3%. It's 20% of my portfolio because I believe strongly in the CEO, their products and services and the long term growth oulook.

Everything is over valued, my as well own the one company that actually consistently provides value.

Everything is over valued, my as well own the one company that actually consistently provides value.

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

+1Pre marlet AAPL is up almost 3%. It's 20% of my portfolio because I believe strongly in the CEO, their products and services and the long term growth oulook.

Everything is over valued, my as well own the one company that actually consistently provides value.

Bought 100 shares 10 years ago. I've sold a bunch but it's about 15% of our holdings.

BeachOrCity

Full time employment: Posting here.

- Joined

- Jun 1, 2016

- Messages

- 892

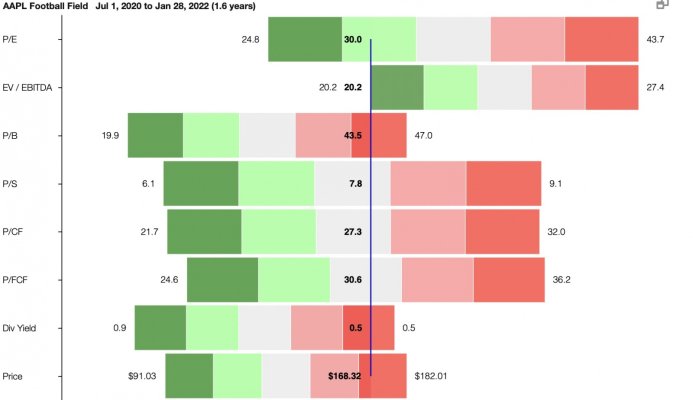

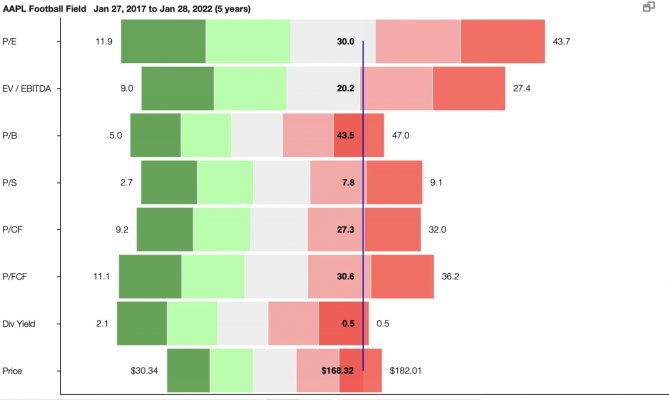

I thought I would include two "football field" charts from stock rover. Each one is where Apple valuation lies vs historical. The line down the center shows current position of value. One is current valuation vs range over 18 months (shows Apple fairly valued). The other shows current vs range over 5 years (shows apple somewhat expensive at current pricing).

Attachments

Similar threads

- Replies

- 10

- Views

- 736

- Replies

- 38

- Views

- 2K

- Replies

- 4

- Views

- 1K

- Replies

- 41

- Views

- 5K