Anyone here actually beat SP500 return in the last 3 years? .. If so if you don't mind sharing your knowledge and choices of holding..

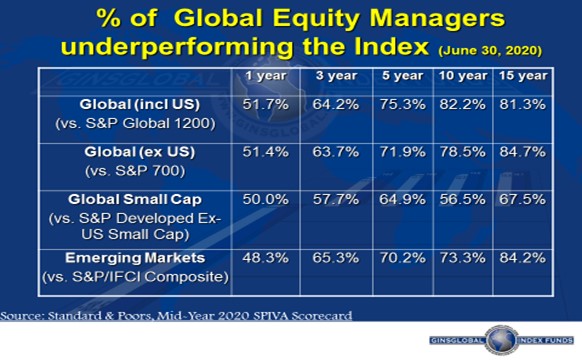

I am happy to pay a Financial Advisor or an Agency such as Edward Jones, Vanguard, or Fidelity if they can prove that the last 3 years they managed portfolios that actually beat the SP500.

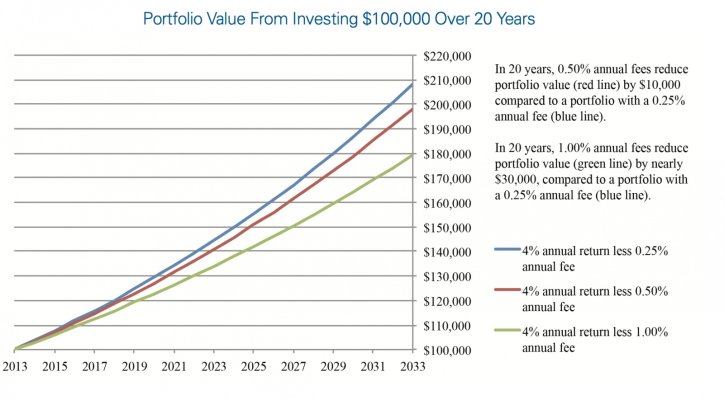

My experience talking to these people folks are about "balance and diversify", invest not to lose... after said and done, it seems like they were suggesting us to similar index like SP500 + some less risky bonds and want 1% fee.

I have 100% of my investment in SP500 for now. I hope to retire in 2,3 years. Kids are finishing up college.

Please recommend me an agency that can have deliever such promise. Maybe I live in the fantasy land.

Enuff

I am happy to pay a Financial Advisor or an Agency such as Edward Jones, Vanguard, or Fidelity if they can prove that the last 3 years they managed portfolios that actually beat the SP500.

My experience talking to these people folks are about "balance and diversify", invest not to lose... after said and done, it seems like they were suggesting us to similar index like SP500 + some less risky bonds and want 1% fee.

I have 100% of my investment in SP500 for now. I hope to retire in 2,3 years. Kids are finishing up college.

Please recommend me an agency that can have deliever such promise. Maybe I live in the fantasy land.

Enuff