Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,563

I bought into Daqo New Energy (DQ) a couple weeks ago at $57.10. This company is the world's #1 supplier for high-purity polysilicon for the global solar PV industry. Basically they provide the raw material to make solar cells. They are based in Shanghai, China.

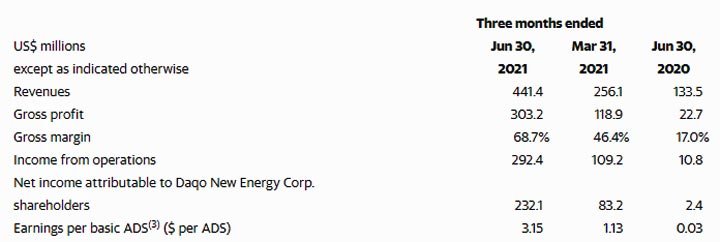

They reported earnings yesterday.

Here's the revenue portion of the Income Statement:

Increasing revenue. Check

Increasing profit margin. Oh yeah.

Increasing earnings. Definitely

Looks pretty good to me!

But, stock price is down today and has fallen from $56 a share a week ago to $46 today.

The stated reason is earnings per share didn't meet expectations, but look again at the jump in EPS from just last March.

What's really going on here?

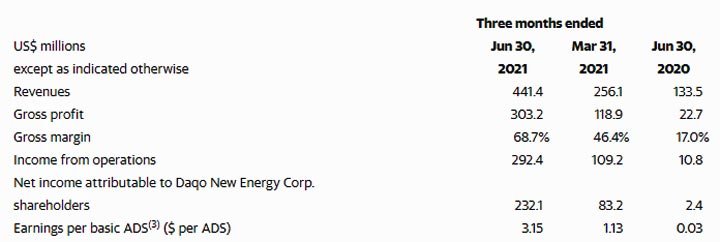

They reported earnings yesterday.

Here's the revenue portion of the Income Statement:

Increasing revenue. Check

Increasing profit margin. Oh yeah.

Increasing earnings. Definitely

Looks pretty good to me!

But, stock price is down today and has fallen from $56 a share a week ago to $46 today.

The stated reason is earnings per share didn't meet expectations, but look again at the jump in EPS from just last March.

What's really going on here?

Last edited: