You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Down Day in the Market !

- Thread starter frayne

- Start date

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

And how to activate the Plunge Protection Team.This is all because Janet Y. forgot to show the new guy the rigging machine.

Helps if You Own the Bonds and Hold to Maturity

Bond funds will generally suffer with rising bond rates, particularly the medium to long term funds. This is because 1) Bonds purchased today and in the near future likely pay higher rates as rates rise 2) Bonds held by any fund, particularly medium to long term bonds, lose their value as their relative interest rate advantage versus new bonds lessens 3) Funds must sell these lower valued bonds to payoff fund member withdrawals. Hence, the fund value per "share" decreases.

If you instead are purchasing government or corporate bonds outright, with the intent of holding them to maturity, rates you receive today are better than the recent past, and will improve in months/years to come.

We are coming out of the lowest interest rate cycle in history - rates have nowhere to go but up, in my opinion, and the cycles are very long generally, often rising or falling for 5-10 years or more.

Bottom line is when one talks about bonds increasing or decreasing returns, it is very different for bond funds vs. individual bonds. Right now, bond funds look like they may back off in either rate paid or principle value. Bonds themselves should offer much better interest returns for some years to come.

I am NOT in any way a financial professional, so I welcome any clarification or corrections to what I stated above.

So, I haven't read through every of the 300+ posts here and this may/may not have come up but here's my question:

The market drop seems to have been a reaction to rising bond rates. Doesn't that mean that those of us with bonds/bond funds will slowly, slowly start to see an increase in our interest payouts? I realize it could take a while (years?) to see an increase; or does this look like a blip on that front?

Bond funds will generally suffer with rising bond rates, particularly the medium to long term funds. This is because 1) Bonds purchased today and in the near future likely pay higher rates as rates rise 2) Bonds held by any fund, particularly medium to long term bonds, lose their value as their relative interest rate advantage versus new bonds lessens 3) Funds must sell these lower valued bonds to payoff fund member withdrawals. Hence, the fund value per "share" decreases.

If you instead are purchasing government or corporate bonds outright, with the intent of holding them to maturity, rates you receive today are better than the recent past, and will improve in months/years to come.

We are coming out of the lowest interest rate cycle in history - rates have nowhere to go but up, in my opinion, and the cycles are very long generally, often rising or falling for 5-10 years or more.

Bottom line is when one talks about bonds increasing or decreasing returns, it is very different for bond funds vs. individual bonds. Right now, bond funds look like they may back off in either rate paid or principle value. Bonds themselves should offer much better interest returns for some years to come.

I am NOT in any way a financial professional, so I welcome any clarification or corrections to what I stated above.

Last edited by a moderator:

One has to define "handle". What does it mean?

Yes, I survived the 2000-2001 and 2008-2009 tough times, but did not have enough to lose a Rimac. If I do now, even if it's the same percentage as before, oh man, it's a lot of money.

I would not jump out of the window, or eat cat food. But it would hurt like the dickens.

I side-stepped some of the 2000-2001 decline because the valuations were so ridiculous that I couldn't justify holding onto some of the stuff. So I went into that decline with a fairly high percentage of cash on hand.

I entered the decline of 2008-2009 fully invested. It was an unpleasant drop, but my net worth was about quarter of what mine is now.

With the bigger dollar amounts at stake, and being a decade older, and now having young kids, I've been trimming back my stock allocation a little for the last couple of years. I didn't want to go through another huge decline without some cash on hand again.

So we were 70/30 when this started last week instead of 100% stocks, which was always my more natural inclination.

I'm not seeing anything I'm particularly excited about buying yet.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It stopped being house money when I retired to live off my investments.Pretty easy to laugh off when you're playing with house money.

Most big mistakes aren't made until real pain sets in.

Kudos to all who rebalanced and super kud's to those who "won the game" and adopted a more conservative AA

Even if my triggers were tighter, there is no way I’m that nimble.

And here we are dropping big again. Was the recent low taken out? Looks close.

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I just heard on CNBC that someone lost their life savings on one of those 8X VIX inverse whatevers. I guessing they're about 25 years old with $3500.00 invested.

Those ETNs have been the culprit. The market would have sold off anyway due to higher interest rates and fears of increasing inflation. But those crazy investment vehicles made it much more sudden and painful.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

So, I haven't read through every of the 300+ posts here and this may/may not have come up but here's my question:

The market drop seems to have been a reaction to rising bond rates. Doesn't that mean that those of us with bonds/bond funds will slowly, slowly start to see an increase in our interest payouts? I realize it could take a while (years?) to see an increase; or does this look like a blip on that front?

My HY fund had been paying about 8% back in the day and is now at 5.5%...it would be a welcome change for me!

Ironically, if the equity market drops enough, bonds will rally = interest rates drop.

That happened on Monday, but then i Teresa rates resumed their climb and now pressuring stocks again.

So I expect see-saws for a while.

A big part of the last 14 months of big US rally has been the dollar weakening and persistent low interest rates. Now the game has changed.

DrRoy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

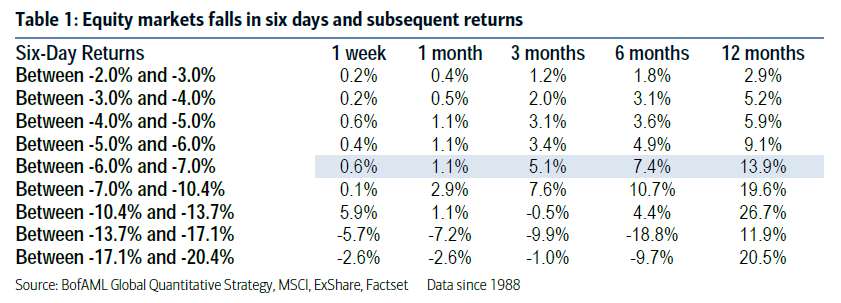

We have all been really complacent. The market rout so far is technically not even a correction yet. The S&P is down only about 7.5% since the top in Jan 26, and needs to go another 2.5%.

Compare that to the extreme violent moves in 2008, there were days when the S&P dropped close to 10% in a single day. But it also bounced up the same 10% in a single day.

Ah, that was a truly exciting and scary time.

The S&P 500 since the last election set an all time record for going w/o a 3% drop. People get used to such things as “normal” and then freak out over typical market moves like this.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,716

I've been thinking about the drop lately, and the one thing that comes to mind is:

"Sawtooth Curve"

So many things in life go by the sawtooth. Yet in our minds, we want them all to be nice, clean, smooth sine waves. Not so with the market. I think that is what makes it so unsettling.

The most damaging things in life and death are like this. Heart disease. Drug use. Car accidents.

Things build slow and unwind fast. Been around enough in the market, and it just is the way it goes.

"Sawtooth Curve"

So many things in life go by the sawtooth. Yet in our minds, we want them all to be nice, clean, smooth sine waves. Not so with the market. I think that is what makes it so unsettling.

The most damaging things in life and death are like this. Heart disease. Drug use. Car accidents.

Things build slow and unwind fast. Been around enough in the market, and it just is the way it goes.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,703

So, I haven't read through every of the 300+ posts here and this may/may not have come up but here's my question:

The market drop seems to have been a reaction to rising bond rates. Doesn't that mean that those of us with bonds/bond funds will slowly, slowly start to see an increase in our interest payouts? I realize it could take a while (years?) to see an increase; or does this look like a blip on that front?

My HY fund had been paying about 8% back in the day and is now at 5.5%...it would be a welcome change for me!

I pay more attention to the monthly cents-per-share dividend my bond fund pays out, not so much how its NAV changes. Back in late 2008, when I began investing in the borderline investment-grade corporate bond fund, it paid out 5 cents per share per month. That has eroded slowly in the last 9 years down to around 3 cents per share per month, or 60% of what it had been paying before. I have about 50% more shares than I did then, so taken together I get about 90% (0.60 x 1.5) of what I was getting in monthly dividends back in late 2008.

I would welcome a return to 5 cents per share per month, even 4 cents per share per month would be nice; the NAV has been pretty steady as the dividends have dropped.

FIREmenow

Full time employment: Posting here.

- Joined

- May 9, 2013

- Messages

- 756

Dow -3.6%.....

copyright1997reloaded

Thinks s/he gets paid by the post

Nibble: Buying $10K in Large Cap Value at EOD in my 401k.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,716

Who is going to start the "Dow 20k by April 1" thread?

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We are now officially in a "Correction" in S&P 500. <10.1%>

and also in DJIA <10.3%>

Only NASD remains above the correction territory at <8.96%>

Oh wow, really!

That was fast.

I doubt the selling is done, but what do I know?

frayne

Thinks s/he gets paid by the post

Remember folks, points don't mean sheet, it's all about percentages.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Is that an April Fools joke? If not, why so far out?Who is going to start the "Dow 20k by April 1" thread?

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Had a heavier lunch than normal. Fell asleep. Woke up and saw market just close with the Dow down -1033 points. Felt like back in 2008.

I wanted to see some excitement. This is a bit too much. More fun like this tomorrow?

Bye bye an Audi S6 today.

PS. Quicken stock quotes run 20 minutes behind. Make it an S7.

Who else blowing dough?

I wanted to see some excitement. This is a bit too much. More fun like this tomorrow?

Bye bye an Audi S6 today.

PS. Quicken stock quotes run 20 minutes behind. Make it an S7.

Who else blowing dough?

Last edited:

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Remember folks, points don't mean sheet, it's all about percentages.

Today was the 156th largest % one day drop in history. Yawn. I may buy next week with some dry powder.

ExNavy In STL

Confused about dryer sheets

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Remember folks, points don't mean sheet, it's all about percentages.

True. Percentage wise, we had nearly 10% daily drop in 2008. So far, it took several days to drop the same.

But I am still not used to using Audis as a measure of daily loss. I was using Honda Civic before.

And I am still driving Civic.

PS. This kicks me back to the end of Sep 2017. How 'bout y'all?

Last edited:

Similar threads

- Replies

- 0

- Views

- 220

- Replies

- 144

- Views

- 9K

- Replies

- 16

- Views

- 567

- Replies

- 44

- Views

- 3K

- Replies

- 26

- Views

- 1K