Grumpyretirement

Dryer sheet wannabe

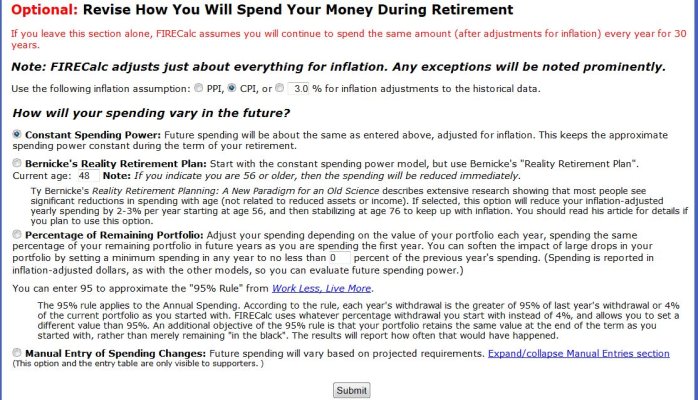

It would be nice if you had the ability to add several more lines of other income or off chart spending. Just provide the option to add up to 10 or more lines of changes. And for each change, have a start and end date. Would allow more flexibility for including when mortgage is paid off, etc.

If anyone knows how to add more than the 3 lines provided, let me know, please.

Thanks.

If anyone knows how to add more than the 3 lines provided, let me know, please.

Thanks.