ducky911

Recycles dryer sheets

- Joined

- May 18, 2010

- Messages

- 497

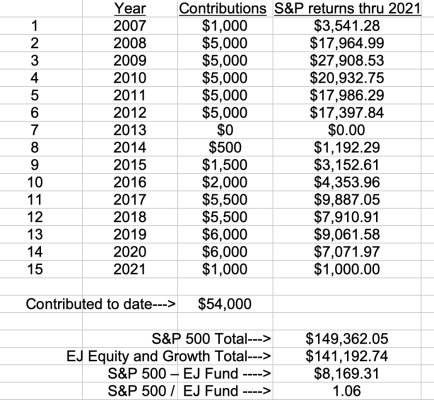

2007 - $1,000.

2008, 2009, 2010, 2011 and 2012 - $5,000 each year.

2013 - $0.

2014 - $500.

2015 - $1,500.

2016 - $2,000.

2017 and 2018 - $5,500 each year.

2019 and 2020 - $6,000 each year.

Thus far, I have contributed $1,000 toward my 2021 contributions.

that is $140,354.00

And you would have had to pay some taxes along the way that would lower that number. My gut says it should have been much higher than E jones....How risky have they been? maybe I made a math error?