NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

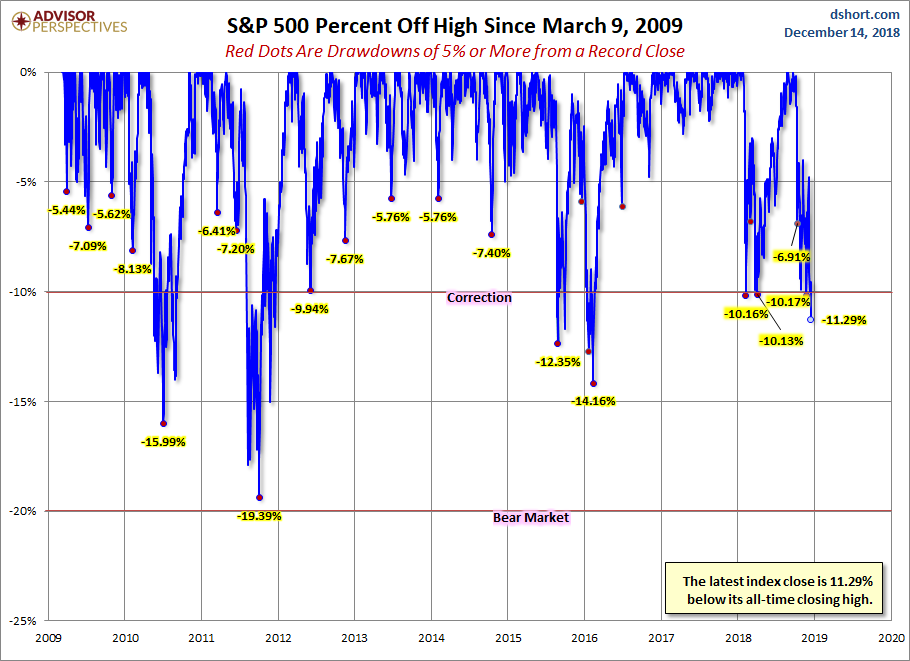

And even with recent drops, my total yesterday was 40% higher than on that Wheee!!! day.

It's 20% after accounting for inflation.

Still OK though, considering the 10 years of WR for living expenses.