Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

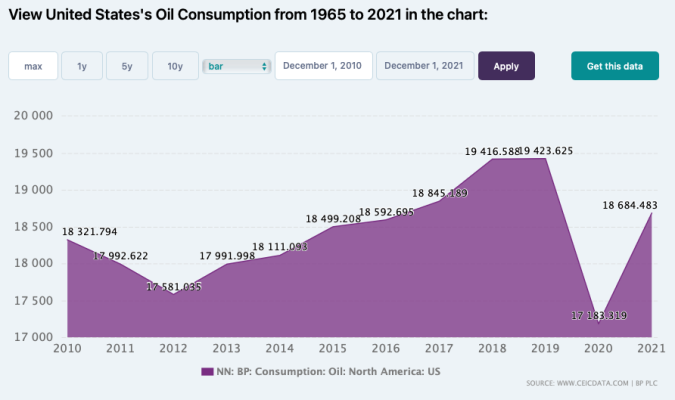

Well, permitting on federal lands has been slow or stopped. So there are hurdles.No, not at all. In fact, it is the epitome of capitalism in its purest form - maximize profits. My point in highlighting it was as a counter to all of the rhetoric about government restrictions being the cause of high gas prices. I'll concede that the government plays a role, but I'd submit that the oil and gas industry has much more control over pricing and is often overlooked. While there are ample opportunities for more drilling right now, including on federal land, energy companies choose not to do so, which is their prerogative. And the comments regarding refinery capacity are duly noted.

And the government's dangerous anti-carbon posture chills new investment, keeping prices high.

If the head of government vowed to end your industry, and had signed numerous orders intended to reduce output, would rushing to invest in new wells be wise?

You mean there is a supply/demand curve?

You mean there is a supply/demand curve?