nash031

Thinks s/he gets paid by the post

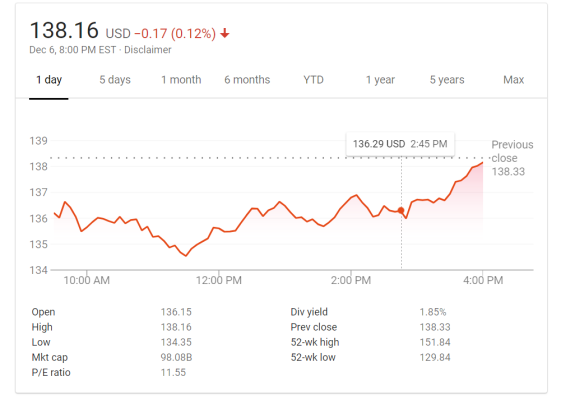

So is anyone buying? I did a little buying at the end of Oct (?) or so when the market went down to about similar levels but I think I'm going to stay put this time unless the market drops another 5%+

I've now taken three nibbles (about 10% of my cash allocation each time) on days where S&P was down 10% or more from its peak. Still sitting on about 10% cash position overall that I plan to move in slowly over the course of time, hopefully riding the way down before a market turn.