ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

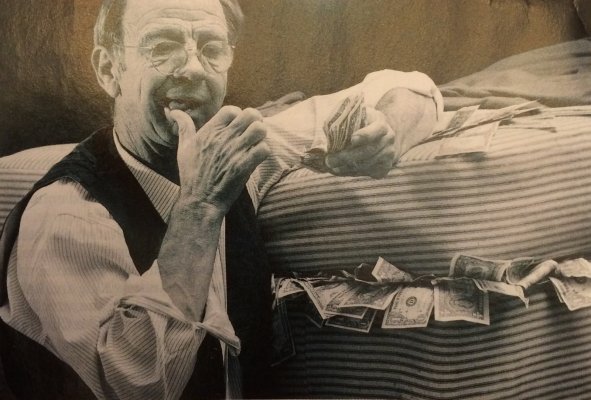

With the turmoil in the banking system, Perceived Schwab Woes, and other financial uncertainties, I was wondering where we (ER Members) kept the "Majority" of our stashes.

This Poll is intended for those who keep The Majority their stashes in one or more Brokerages, the main ones being Fidelity, Schwab and Vanguard. As opposed to significantly small amounts in Checking Accounts Etc.

If you use another institution or Brokerage, please feel free to select "Other" and if you like, highlight in the posts.

If you use a combination of institutions, and if you like, highlight in the posts.

This poll is simply for curiosity purposes with no underlying reasoning as I am thinking of adding Fidelity to our Schwab accounts for our IRAs. We do keep our day-to-day funds in a local Credit Union Checking Account, but I have not included this in my selection.

This Poll is intended for those who keep The Majority their stashes in one or more Brokerages, the main ones being Fidelity, Schwab and Vanguard. As opposed to significantly small amounts in Checking Accounts Etc.

If you use another institution or Brokerage, please feel free to select "Other" and if you like, highlight in the posts.

If you use a combination of institutions, and if you like, highlight in the posts.

This poll is simply for curiosity purposes with no underlying reasoning as I am thinking of adding Fidelity to our Schwab accounts for our IRAs. We do keep our day-to-day funds in a local Credit Union Checking Account, but I have not included this in my selection.

Last edited: