- Joined

- Nov 27, 2014

- Messages

- 9,255

Not sure I have all the elements considered, but wanted to run my concerns by the group to get your thoughts.

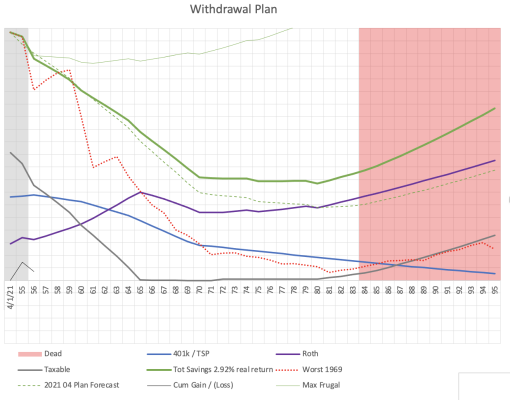

I was looking over my 2021 spending and firming up my 2022 budget. Generally, my budget is $100K and after I did my initial budget run I was at $110. My initial thought is that it was mostly due to inflation. I had bumped up my utilities, gasoline and food pretty significantly. Certainly I had some additional expenses in there too.

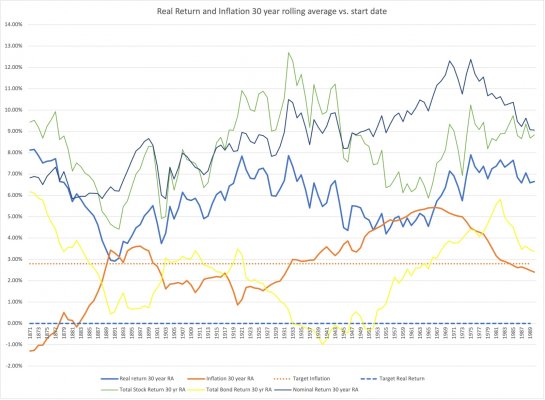

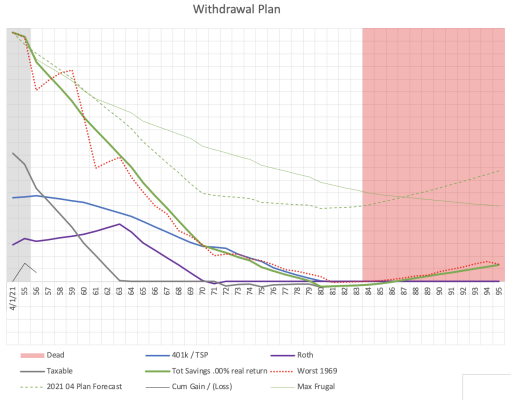

My thought was to revisit my retirement calculator and see how things looked at a spending level of $10K more than planned. In that thinking, I realized that there was a major assumption that was built into my calculations, and I believe this is common - that the rate of inflation and the rate of portfolio growth were the same. This, I thought, was a rather conservative assumption.

Understanding inflation and portfolio return are lumpy, at best, what assumptions would you make if you're doing or re-doing a retirement calculation today?

I was looking over my 2021 spending and firming up my 2022 budget. Generally, my budget is $100K and after I did my initial budget run I was at $110. My initial thought is that it was mostly due to inflation. I had bumped up my utilities, gasoline and food pretty significantly. Certainly I had some additional expenses in there too.

My thought was to revisit my retirement calculator and see how things looked at a spending level of $10K more than planned. In that thinking, I realized that there was a major assumption that was built into my calculations, and I believe this is common - that the rate of inflation and the rate of portfolio growth were the same. This, I thought, was a rather conservative assumption.

Understanding inflation and portfolio return are lumpy, at best, what assumptions would you make if you're doing or re-doing a retirement calculation today?