TSLA had two up days this week, but I think only one that was up more than the market. But they have not closed higher than their close on the day of the drop (1/18 @ $302.26), so I'd still call it a 'drop', not a 'dip'.

Well yes. For one it is a typical Jim Cramer article, it both seems to be bullish and bearish at the same time so it could claim to have been supporting either position. The article in and of itself made no analysis other than the note that TESLA is pretty likely to survive and only the stock valuation is an issue, which I think is very much in question myself. …..

Well, one might say it is a 'balanced' article then, showing both the upside and downside possibilities. After all, no one really knows, or we'd all be stock picking geniuses with more money than we know what to do with by now, and wouldn't even be interested in this.

Are you questioning that Tesla is "pretty likely to survive", or that "only the stock valuation is an issue"? Or both?

... If one believes that it is very likely Tesla will survive then there is no reason not to jump into the 8/25/2025 notes yielding 8 percent over the next 6 1/2 years, triple the US Treasury yield.

That is equivalent to getting Tesla to 500 by that date, and assuming the stock is diluted by then the company would have to be probably over 100Billion market cap. And all you need is the company to survive…..

Interesting. Off hand, and with not enough information, and no crystal ball, I would guess that "surviving" until 8/25/2025 is more likely than a $500 stock price. But 6 1/2 years is a long time for a company with this many challenges, so I will probably pass on both opportunities. Though the bond is a little tempting for some casino/testosterone trading money.

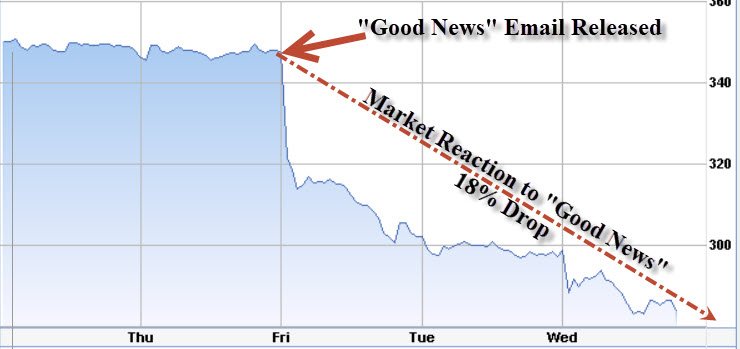

This seems pretty darn bad--

https://finance.yahoo.com/news/tesl...pany-reportedly-cut-production-173200619.html

“We recently announced that we are no longer taking orders for the 75 kWh version of Model S and X in order to streamline production and provide even more differentiation with Model 3. As a result of this change and because of improving efficiencies in our production lines, we have reduced Model S and X production hours accordingly. At the same time, these changes, along with continuing improvements, give us the flexibility to increase our production capacity in the future as needed."

This tells me that they have more than met the demand for Model S and X vehicles. If they could sell additional Model S and Model X vehicles, why would they reduce their production hours?

That, along with the price decrease they announced recently for the Model 3, makes me suspect that they are starting to have trouble finding buyers for their cars at the current high prices. They've got a big backlog of people waiting for cars, but it looks like it is probably mostly people who want the mythical "$35k" Model 3.

I think Q4 is going to have a lot of red flags in it, and I bet their Q1 numbers are terrible.

I agree it looks bad, but I think we need to see how China/EU plays into this for a while. It makes sense for them to sell the 'loaded' models while there is demand in this new market. But it does look like Tesla is getting caught in the US - is demand really drying up for the higher loaded models? And are they just not yet in a position to make decent margins on the lower priced models? If that is the case (and it appears to be, but appearances can be deceiving), that looks like trouble. But then again, maybe, just maybe, they can feed off the higher models to China/EU while they improve efficiencies for the lower models?

I'm skeptical that they can pull that off, I doubt there is enough efficiency to be gained in that short of a time if demand has dropped for the high end here in the US. But I won't rule it out either. I think I read that they have some flexibility on cashing in some 'zero-pollution' credits from other manufacturers? Maybe that can pull them through?

I think Q1 reports may still be hard to decipher, due to early demand in China/EU. More telling will be Q3/Q4 as the tax credit drops further, and if they really are pushed to deliver the $35,000 M3 in volume.

edit/add: I actually think Tesla's biggest mistake was not raising the price on

all the models from the start - as long as demand exceeded their production capability, and especially while the tax credits were in full force. It would be easy to explain that this is part of the plan, to drop prices as their efficiencies and economy of scale allowed. They could have celebrated each incremental price drop as another successful goal post. Instead, they've allowed the tail to wag the dog here, and look to be forced to sell lower models at prices that might not provide a decent gross margin. They can never get that margin opportunity from the early adopters again.

-ERD50