Thanks @big-papa. Appreciate it.

OK. Here you go. It turns out I had this analysis stuffed away already. So here's the setup:

Data is from the Simba Spreadsheet over on Bogleheads

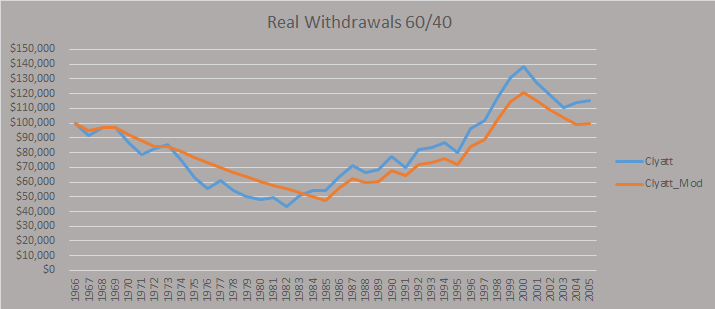

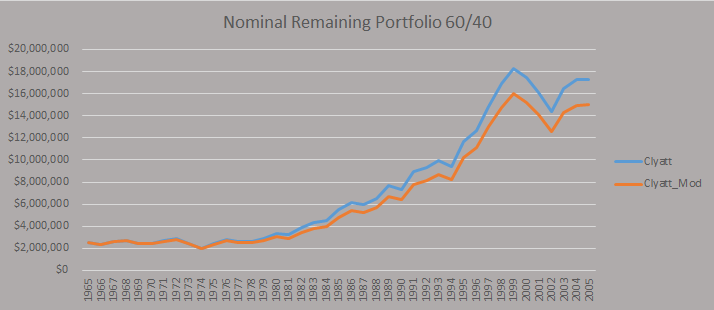

This is a 60/40 Portfolio with 60% Total Stock Market (VTSMX) and 40% Intermediate Treasuries. The difference won't be much if you used an SP500 fund and/or a total bond fund.

Clyatt is: 4% of the remaining nominal portfolio or 95% of the previous year's nominal withdrawal, whichever is larger.

Clyatt_Mod is: 4% of the remaining nominal portfolio or 95% of the previous year's real withdrawal, whichever is larger.

First plot is the real withdrawals for both methods.

Second plot is the nominal Remaining portfolio.

Because I had already had this built up, I did it for 40 years.

Results are as I discussed before. In real terms, using 95% real, definitely smooths things over during this timeframe, but there is a small penalty in that you're withdrawing more from your portfolio.

At 30 years, the remaining portfolio for Clyatt is: $11.7M

At 30 years, the remaining portfolio for Clyatt_Mod is: $10.2M

Of course the spending power from both portfolios is significantly less by that time.

For Clyatt, the minimum real withdrawal is: $43.6K

For Clyatt_Mod, the minimum real withdrawal is: 47.7K

The minimum portfolio value for Clyatt is: $2.02M

The minimum portfolio value for Clyatt_Mod is: $1.99M

For withdrawals starting in 1966, Clyatt was back to $100K by 1997

For withdrawals starting in 1966, Clyatt_Mod was back to $100K by 1998

The charts: