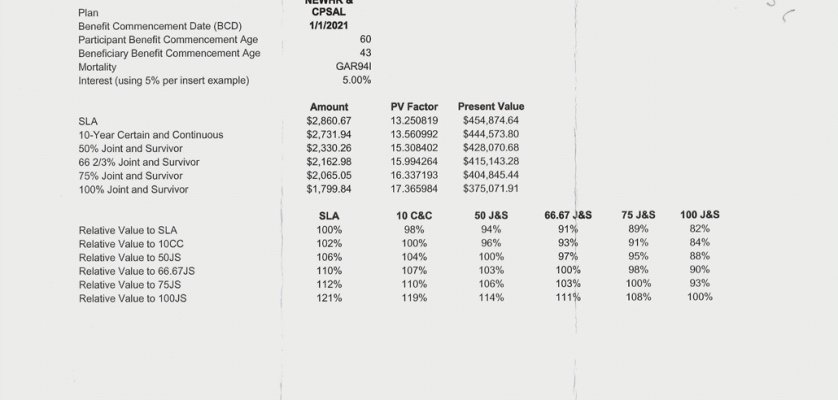

I've attached the relative valuation

After seeing your chart I would do the following.

Take the 10 yr certain and continuous option of $2732/month

purchase a 2nd life ins policy of $500k 20 yr level term which is running about $317/month for 500k for a 60 year old male in above ave health from A- rated insurers (John Hancock etc

This protects your wife from a problem if you die after 70.5 where she would receive nothing if you took the single life pension.

So even if you die in a month(certainly hope not) she still gets the $2732/month for the next 10 years.

At 43 according to immediate annuities.com a female for $500k could purchase a $1602/month SPIA. only $198/month less than the joint and survivor ($1800/month ) option plus she gets the $2732/month or $932 more per month than the JS

At 48 $500k gets a $1687/month SPIA. $133/month less than JS but again $932/month more per month from the 10 yr certain(for 5 years since you would be 65)

At 53 $500k gets a $1799/month SPIA therefore equal to the original JS so no loss to her by waiting.

So $932/month extra - ( $317 for additional life ins premiums)=$615 extra for 10 years or $73800 total net extra dollars.

So if you die before 70.5 she just purchases the SPIA with the insurance proceeds to replace the amount she would have received if you chose the original JS pension and you enjoy the extra money per month in the mean time. In fact I would argue even if you did pass anytime before 70 she could still wait till she was 53 to purchase the SPIA and then receive the same JS as original since she would be getting the $2732 anyway.

But wait there's more:

If you die during before 70 the spouse would get (2) $500K payments and then she could get $1million SPIA's (or the above mentioned ones plus an extra $500k in her pocket)of:

age 43: $3204/month

age 48: $3375/month

age 53: $3597/month.(interestingly still get $3514/month with a life and 20 year certain period so the kids could have 20 years of payments should the wife pass.)

Of course these require you too die young,not a great strategy

After age 53 it then reverts back to

$500k SPIA

age 54: $1829/month

age 58: $1954/month

age63: $2183/month

SS: again you have interesting conditions to consider.

you appear to have:

$1800/month at 62

$2571/month at 67

$3188/month at 70

also $800/month extra from age 62 to 69(oldest kid turns 18)=$67200

and $400.month extra from age 69 to 72(youngest kid turns 18)=$14400

(1800+800)*12*7 years=$218400(1800+400)*12*3 years=$79200

total ss received from age 62 to 72=$297600

if you waited to 70 total ss from 70 to 72 would be $3188/month *24=$76512.

Yes I'm bored and it's raining here

ANYWAY this all might ne a moot point based on your assetts and spending.

It looks to me like you took a WAG at expenses.$2000/month seems way low with a wife and 2 kids and even $4000/month would be very frugal.

Regardless at $4000/ month and 2 million you are only at a 2.4%(or 3% setting aside $400k for the house) WR before any pension and SS so I don't think it is an issue which ever you choose.

so now $297600+1800x=$76512+3188x

x=159 months (13 years and 3 months)

so a "breakeven" #by waiting to claim at 70 would be (72+13.25) about 85 and 3 months. Typically the break even form 62 to 70 is around 80.5 but you have the extra kid money. quite a while but your wife would still only be 68.

Keep in mind that she can only get 100% of your benefit if she waits to her FRA which is 67.

Also it is 100% of what you get when you claim, not your FRA so if you claim at 62 she can never get more than $1800/month but if you claim at 70 she would get the $3188 /month and still be fairly young at 68.