mickeyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Between DW and I we have 6 income streams not including personal investments. Only two of them are SS.

But I found it strange I could begin withdrawing at 60 and she has to wait until 65. Does that mean they changed the rules between when we each started working.

She was hired directly into megacorp, where as I was acquired through an acquisition. Could this be related to the takeover?

Yes, Civil Service Retirement System with COLA and health benefits.

Actually have seven income streams

Military, private pension, county pension, wife SS, my SS, My IRA, Wife's IRA.

Have to admit takes a couple of those just to cover Medicare premiums, but heck no complaints.

Department of Defense (USAF) at Cavalier AFS in ND. I was a software engineer there for 25 years. Also have income from 401K and a small amount from Social Security.Sounds like a nice package. What type of organization?

Hey, does your organization offer any kind of pension program? If so, do you have one and what is it like? Also, do you also have any other source of retirement income?

The OP is asking whether we have a pension. Income streams, such as SS or annuities, in my opinion, are different.

Hey, does your organization offer any kind of pension program? If so, do you have one and what is it like? Also, do you also have any other source of retirement income?

Yes, the spouse does have to sign off. For a lot of reasons it can make sense, depending on the circumstances.

Is that a monthly or annual amount?Yes, as of now I get $88 for every year of employment.

They put a lot of effort into persuading members of the old pension plan to switch to the new one by offering 1/2 of one's pension contributions back in a lump sum. I thought it would be foolish to do that and didn't but a lot of guys took the bait, buying cars, boats, Harleys, and such. They sure are regretting it now.

Is that a monthly or annual amount?

Indeed. Sometimes it may be possible to buy a life insurance policy on the pensioner which is enough to replace the survivor income, for less than the monthly cost of taking the joint-and-survivor option. When that is the case it can indeed make sense to forego all survivor income, take the higher pension payout and get some life insurance with the increased pension payments.

Hey, does your organization offer any kind of pension program? If so, do you have one and what is it like? Also, do you also have any other source of retirement income?

My former Megacorp eliminated further pension contributions in 1994, pension balances were frozen for all active employees, and the funds were only available at retirement age. They eliminated a retiree health care plan a few years later and replaced it with nothing (not sure what they did RE: retirees at the time).

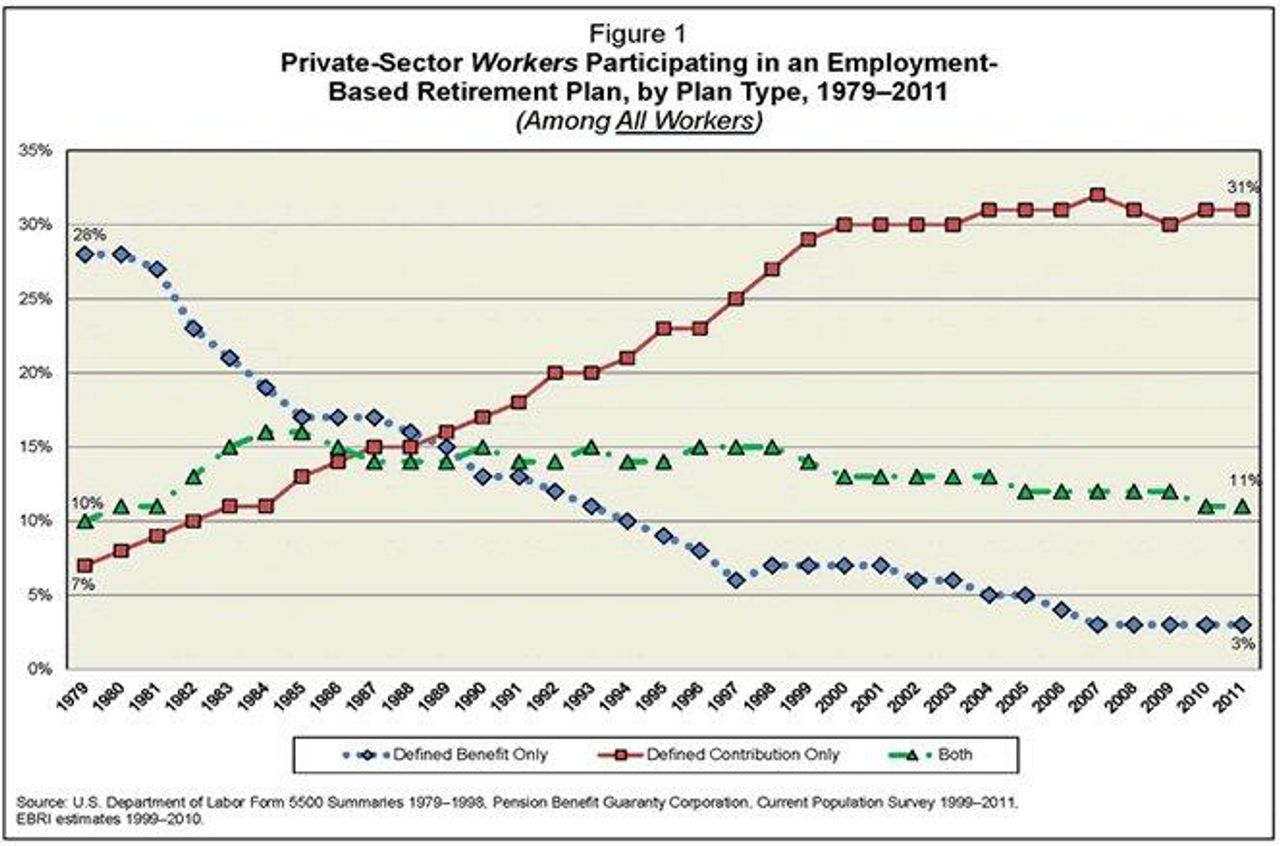

I've seen charts showing the percentage of public sector employees with defined benefit plans are considerably higher, but couldn't find it just now.

He also asked about other sources of retirement income.

After reading all of the replies, I guess I am one of the lucky ones. I work at a law enforcement agency that pays 3% for final highest year at 50. This is a defined benefit for life with A 3% maximum yearly COLA. I plan on reaching FIRE in 3 years when I turn 50 with a 6 figure salary. The new hires are at a 2.7 @ 57 rate which is still great after reading everyone's comments.

People in public safety jobs (policemen, firemen, prison guards) seem to have, as a group, better pension plans that other public employees.

After reading all of the replies, I guess I am one of the lucky ones. I work at a law enforcement agency that pays 3% for final highest year at 50. This is a defined benefit for life with A 3% maximum yearly COLA. I plan on reaching FIRE in 3 years when I turn 50 with a 6 figure salary. The new hires are at a 2.7 @ 57 rate which is still great after reading everyone's comments.