4th Quarter 2018 Update:

For the real RunningMan portfolio I proposed as a 5% withdrawal portfolio with someone of very minor savings ($36,376):

Payments Began March 15, 2015 $150.00/mo

Current Distribution:-- 12/31/2018 $159.00/mo

Total Distributions:———————$6,291.00

Portfolio Value @ 12/31/18: $37,786.67

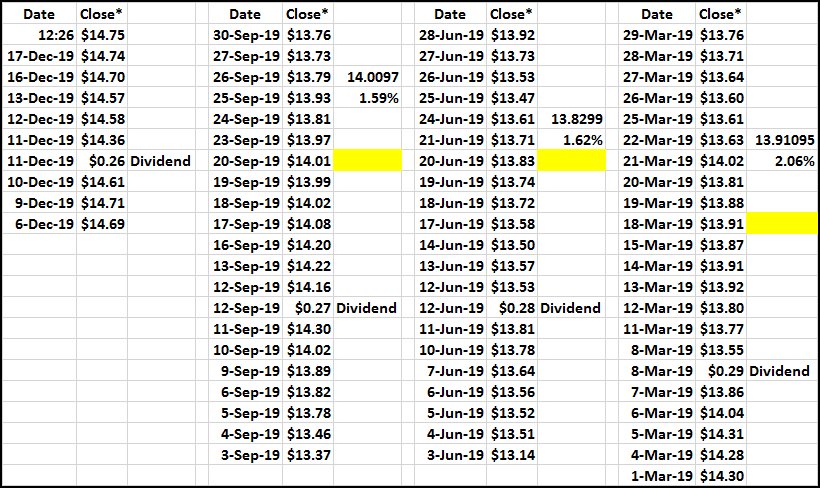

DNP : $26,156.00 --- 2,515 Shares

SDOG: $5,869.50 ----- 150 Shares

RVT : $ 4,956.00 ------- 420 Shares

MMKT : $805.17

Distributions received since last report:$1,374.10 Payments made 954.00

The withdrawal rate on the value of the portfolio is now 5.05%

---------------------------------------------------------------------

Wellington Portfolio for Comparison @ 12/31/18: $35,955.38

VWLEX $35,955.38 960.06 Shares

MMKT: $318.00

Distributions reinvested since last report: $2,659.13 70.05 Shares@ 40.98/37.29

Withdrawal Rate is now 5.31%

The Runningman portfolio had a slightly better year than Wellington, dropping $2,989.58 vs the loss of $3,207.58 for the Wellington. Top value at month end was September @ $42,694.51 Wellington was $38,378.24. During the month of January 2019 the Runningman portfolio recovered nearly $3,000 to $40,737 while the Wellington portfolio underperformed by increasing $1,500 to $37,409. RVT has underperformed the market and the Russell 2000 in the last 12 months putting a bit of a drag on the portfolio. Next update will be the annual realignment at the end of February.