NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

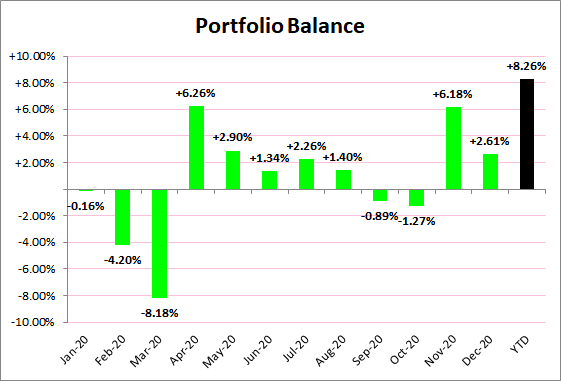

^ nice return!

Thanks. I just checked and saw that the S&P return this year is roughly about the same, yet I am not 100% in stocks.

The difference is that I have been busy with option trading, and it helps. I sell covered calls on some of my stocks, and covered puts on a portion of my cash.