NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

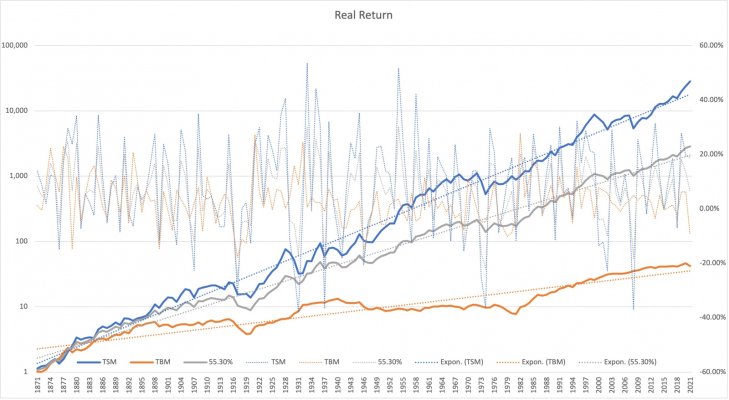

That loss is the effect of bonds and stocks going down at the same time.

Yes.

But the past history of Wellesley includes the terrible years of late 1970s and early 1980s. We had mortgage rates higher than 17% then.

).

).

before buying back in. She's losing less than market right now.

before buying back in. She's losing less than market right now.