target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

First day of full joint retirement. This is similar to my occured at the juncture of my retirement Apr. 1, 2020. SHTF for sure.

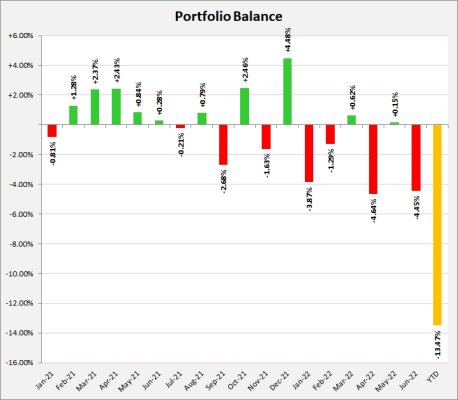

Below is monthly tracking of investments and cash, without performance numbers, just ups and downs, slings and arrows.

50/50 balanced fund (https://finance.yahoo.com/quote/RLBGX/) benchmark is -13.38 YTD. Our balance has decreased approx 13.5% since Jan 1.

We're prepared for another leg down in the market. My guess is at least -10% more to come for stocks. That YTD picture is bloodshot. https://finviz.com/map.ashx?st=ytd

Edit: Here's the lead story in Yahoo today: Stocks shake off losses after S&P 500's worst first half since 1970. Okay, rub it in for clicks!

Below is monthly tracking of investments and cash, without performance numbers, just ups and downs, slings and arrows.

50/50 balanced fund (https://finance.yahoo.com/quote/RLBGX/) benchmark is -13.38 YTD. Our balance has decreased approx 13.5% since Jan 1.

We're prepared for another leg down in the market. My guess is at least -10% more to come for stocks. That YTD picture is bloodshot. https://finviz.com/map.ashx?st=ytd

Edit: Here's the lead story in Yahoo today: Stocks shake off losses after S&P 500's worst first half since 1970. Okay, rub it in for clicks!

Attachments

Last edited: