.... Please define what you consider to be conservative. Is a starting rate of 4%, and adjusting for inflation each year conservative? And then resetting to 4% after a run up? ....

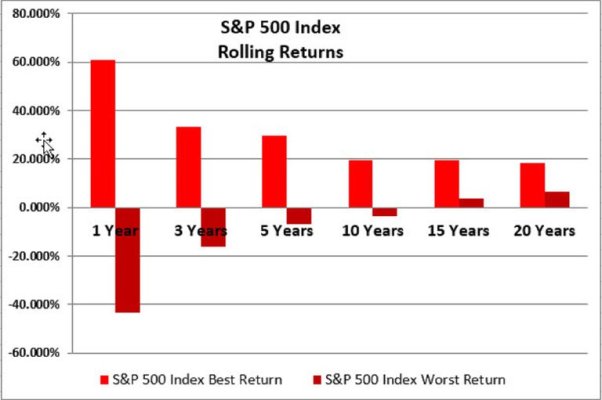

I personally don't consider 4% conservative, others are free to have their own definition. For me, since it failed 5 times out of a hundred based on history, and we all know that the future could be worse than the worst of the past, I like to use 100% as a starting point, and the longest age I think we as a couple might achieve. I use 100, one of us could live longer, but I draw the line there - and it isn't very sensitive to a few more years at that point anyhow.

We are dealing with unknowns, so it becomes somewhat arbitrary. My position was, that to have a "clear conscious" that I could retire early, and not end up needing support from someone, I need to plan for something somewhat worse than the worst in history. And if it comes to that, so be it - you can only plan so far, and that was my limit.

... a starting rate of 4%, and adjusting for inflation each year conservative? And then resetting to 4% after a run up?

Because that's what the OP asked about, and the first post gave an unqualified Yes, it will work. And dory's post gives the same unqualified Yes, and (I think) you and a few others jumped on that as proof. ...

I don't think either of them said it was "conservative" to ratchet up? But (and important here - strictly sticking to the numbers that FIRECalc has in its database) - it works. It has to.

Again, lets use a 100% historically safe WR - it's easier to discuss. So if that is say 3.2% for the time duration you've entered, well, it obviously was 100% for

every period - that's tautology.

So anytime you ratchet it up to 3.2%, you are doing nothing more than re-testing it at 3.2% - it was already tested and passed, right? So it works. Period.

I've experimented with this concept with other tools, and guess what - the 'risky' starting point years like 1966, never provide an opportunity to ratchet up (as expected). They don't get any 'riskier'. What it does is (if you want to put it this way), makes the other years 'riskier'. The useful effect of that is to preserve capital for the bad runs, and allow you to utilize the maximum capital from better runs, leaving less on the table in those cases. It's just arithmetic really.

That's a mechanical/mathematic view of it, with that data set. I can't see anyway for it to not work under those conditions. It's like if A > B and B > C, then A must be > C.

Now, it is 'riskier' (lowers the portfolio balance) to ratchet up? Of course it is! Again, it has to be! Taking more money out can only result in less money remaining. A>B>C.

We are going in circles. I think I mentioned a few posts back - what is "actionable" here? Here' a way I think you could approach it:

A) Find the 100% safe WR for your scenario. This WR% will get you through the worst in history - forget % success, you are covered. If you want to be more conservative, reduce that number to provide a buffer against a really bad future. Put in as much buffer as you feel comfortable with.

B) If you want, evaluate where you think we are in a cycle. But using your logic, that was already considered in A above. So if you think we aren't right a precipice, the only logical thing to do would be to RAISE your spending. But I don;t think that's your point, you are thinking the other way, and saying if we are in a danger area, we need to cut. But we already did that in "A".

OK, I guess I'm done, I can only repeat myself so many times, redundantly, and over and over. It simply boils down to how conservative you want to be. Just recognize that FC is already giving you the worst case in its history - go from there.

-ERD50