I have been watching the market close and earnings reports after the close (about 10 PM local time here) on CNBC. All CEOs are reporting the same issue, excess inventory and the need to discount to clear it. This puts pressure on margins and future earnings and has been causing overpriced stocks to tank. When companies have to discount to sell products and services, it is deflationary. Listen to the conference call from Nike and Carnival and hear for yourselves. Inflation is yesterdays news. The market is forward looking and is discounting the loss of pricing power, higher rates, and higher labor costs of major corporations. Corporations were gouging consumers in 2021 and 2022 and created their own demand destruction. The 6 trillion dollar punchbowl is empty and demand is starting to revert back to pre-pandemic trends with the backdrop of massive amounts of inventory.

Sept 30 (Reuters) - Shares of Nike Inc (NKE.N) hit 2-1/2 year lows on Friday and rattled those of other athletic gear makers, after the company's warning of a margin squeeze from widespread markdowns sparked worries of sector-wide contagion of ballooning inventory.

The world's largest sportswear maker on Thursday became the latest in a line of consumer brands and retailers to underscore the pressure on margins from ramped up discounts, as companies rush to get rid of excess inventory amid slowing demand.

https://www.reuters.com/business/re...-excess-inventory-stronger-dollar-2022-09-30/

If you really believe that the need to discount inventory due to a lack of demand is inflationary, then you need some remedial courses in economics.

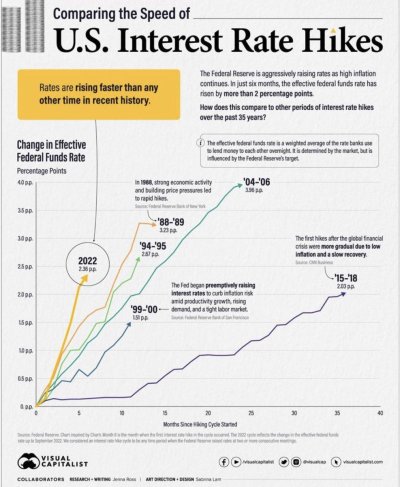

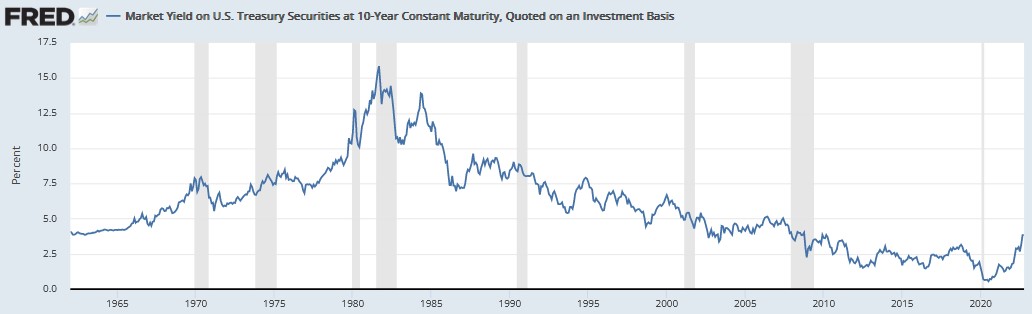

The bond market has priced the Fed funds rate at 4.25% from the 3.25% today and traders are betting that the Fed will pause after that. If they are really serious about fighting inflation, they should hold it at 4.25% for an extended period of time which would be great for savers.