You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2022 Investment Performance Thread

- Thread starter sengsational

- Start date

Well the bad news is I lost over $200k for -17.33%

The good news is I had $200k to lose and am putting in $3.5k per month

Guess I am the poster boy for market volatility and timing. I tried my hand at day trading and lost some money so agreed with DW to get an advisor to curb my tendencies.

Put in $290k at 90% stocks in June 2008, which promptly lost 50% by Feb 2009. Then gains and Covid and this 6 month and counting bear. Still became a millionaire and my CAGR for the 14 years is 5.49% after fees. Not the often advertised 8-10%, but it got the job done. Shows how SWR can hold up in a tough return environment. Took a little off the table after the Covid bounce so currently at 80% stocks. One more double and I will be out. Also have a much greater appreciation for sequence of return risk.

The good news is I had $200k to lose and am putting in $3.5k per month

Guess I am the poster boy for market volatility and timing. I tried my hand at day trading and lost some money so agreed with DW to get an advisor to curb my tendencies.

Put in $290k at 90% stocks in June 2008, which promptly lost 50% by Feb 2009. Then gains and Covid and this 6 month and counting bear. Still became a millionaire and my CAGR for the 14 years is 5.49% after fees. Not the often advertised 8-10%, but it got the job done. Shows how SWR can hold up in a tough return environment. Took a little off the table after the Covid bounce so currently at 80% stocks. One more double and I will be out. Also have a much greater appreciation for sequence of return risk.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

.... Put in $290k at 90% stocks in June 2008, which promptly lost 50% by Feb 2009. Then gains and Covid and this 6 month and counting bear. Still became a millionaire and my CAGR for the 14 years is 5.49% after fees. Not the often advertised 8-10%, but it got the job done. Shows how SWR can hold up in a tough return environment. Took a little off the table after the Covid bounce so currently at 80% stocks. One more double and I will be out. Also have a much greater appreciation for sequence of return risk.

$290k invested in VTSAX (Total Stock) in June 2008 would be worth $1,021,750 at the end of June 2022... for a CAGR of 9.35% with dividends reinvested according to Portfolio Visualizer.

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

| Vanguard Total Stock Mkt Idx Adm | $290,000 | $1,021,750 | 9.35% | 16.53% | 33.52% | -35.10% | -46.68% | 0.59 | 0.86 | 1.00 |

Well the bad news is I lost over $200k for -17.33%

The good news is I had $200k to lose and am putting in $3.5k per month

Guess I am the poster boy for market volatility and timing. I tried my hand at day trading and lost some money so agreed with DW to get an advisor to curb my tendencies.

Put in $290k at 90% stocks in June 2008, which promptly lost 50% by Feb 2009. Then gains and Covid and this 6 month and counting bear. Still became a millionaire and my CAGR for the 14 years is 5.49% after fees. Not the often advertised 8-10%, but it got the job done. Shows how SWR can hold up in a tough return environment. Took a little off the table after the Covid bounce so currently at 80% stocks. One more double and I will be out. Also have a much greater appreciation for sequence of return risk.

We've been re-investing dividends all along putting approx $1500/month back into index funds. Our 10-year CAGR is over 5%. It's what we expected.

38Chevy454

Thinks s/he gets paid by the post

Down 25.19% through June 30th. AA = 89/10/1. It's been a rough ride, especially June. But it's almost all long term money (except for the fixed income side) so staying at my AA and riding it out.

$290k invested in VTSAX (Total Stock) in June 2008 would be worth $1,021,750 at the end of June 2022... for a CAGR of 9.35% with dividends reinvested according to Portfolio Visualizer.

Well, I guess I am also the poster child to why not pay an advisor if you can control your impulses

ATXFIRE2034

Recycles dryer sheets

YTD portfolio performance: -12.2%

AA = 92.7% equities / 0% bonds / 7.2% cash / 0.2% crypto

AA = 92.7% equities / 0% bonds / 7.2% cash / 0.2% crypto

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

One more trading day to go in July.

VTSAX Total US Market is YTD Return -15.15%

VBTLX Total Bond is YTD Return -8.45%

VTSAX Total US Market is YTD Return -15.15%

VBTLX Total Bond is YTD Return -8.45%

KCGeezer

Thinks s/he gets paid by the post

- Joined

- Jan 2, 2015

- Messages

- 1,539

I’m still down a bit over 13%. Held onto the bond fund way too long and can’t see dumping my solar or EV stocks at this point. I still believe in them long term.

July 29 at market close

Jan YTD -4.3%

Feb YTD -6.6%

Mar YTD -4.8%

Apr YTD -11.6%

May YTD -11.5%

Jun YTD -17.6%

Jul YTD -12.0%

Up 7.1% for the month. Let's see if it starts a trend or is just a brief respite.

Jan YTD -4.3%

Feb YTD -6.6%

Mar YTD -4.8%

Apr YTD -11.6%

May YTD -11.5%

Jun YTD -17.6%

Jul YTD -12.0%

Up 7.1% for the month. Let's see if it starts a trend or is just a brief respite.

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Jan 31, YTD -4.18%, stock AA 78.0%

Feb 28, YTD -3.22%, stock AA 73.8%.

Mar 31, YTD -0.18%, stock AA 74.7%

Apr 30, YTD -7.57%, stock AA 74.6%

May 31, YTD: -4.44%, stock AA 72.4%

Jun 30, YTD: -12.2%, stock AA 70.8%

June was a really bad month. It can only go up from here.

Jul 29, YTD: -7.64%, stock AA 71.6%

jimbee

Thinks s/he gets paid by the post

- Joined

- Oct 11, 2010

- Messages

- 1,229

Down 11% year to date, AA of 53(stocks)/47(bonds).

Osprey

Recycles dryer sheets

- Joined

- Jul 28, 2016

- Messages

- 144

-7.42% ytd 53s/47b

Andre1969

Thinks s/he gets paid by the post

Here's my latest rundown...

1/31/2022: -5.07% YTD

2/28/2022: -7.26% YTD

3/31/2022: -4.98% YTD

4/29/2022: -13.11% YTD

5/31/2022: -13.55% YTD

6/30/2022: -20.87 YTD

7/29/2022: -13.54% YTD

I bottomed out on 6/17, when I was down 22.64%. Hopefully, I don't re-test that low-point!

1/31/2022: -5.07% YTD

2/28/2022: -7.26% YTD

3/31/2022: -4.98% YTD

4/29/2022: -13.11% YTD

5/31/2022: -13.55% YTD

6/30/2022: -20.87 YTD

7/29/2022: -13.54% YTD

I bottomed out on 6/17, when I was down 22.64%. Hopefully, I don't re-test that low-point!

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,575

Down 11.8% YTD on a ~80/20 AA.

Lakedog

Full time employment: Posting here.

- Joined

- May 23, 2007

- Messages

- 984

Up 6.6% YTD, still heavy to energy but down to 30% equities (from over 50% near the end of 2021). Have been trading a bit on the ups/downs in my Roth and HSA, and both are up over 20% YTD.

Last edited:

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

New month on the rise, old one almost in the record books.First day of full joint retirement. This is similar to my occured at the juncture of my retirement Apr. 1, 2020. SHTF for sure.

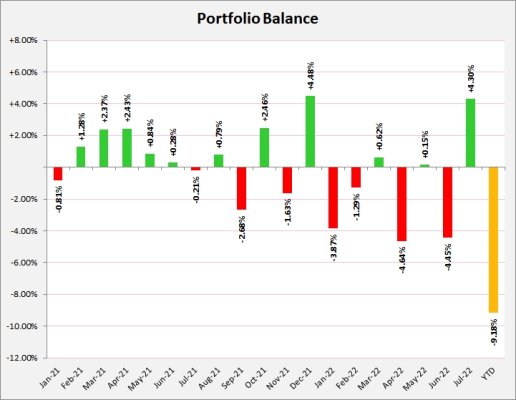

Below is monthly tracking of investments and cash, without performance numbers, just ups and downs, slings and arrows.

50/50 managed balanced fund (https://finance.yahoo.com/quote/RLBGX/) benchmark is -13.38 YTD. Our balance has decreased approx 13.5% since Jan 1.

We're prepared for another leg down in the market. My guess is at least -10% more to come for stocks. That YTD picture is bloodshot. https://finviz.com/map.ashx?st=ytd

Edit: Here's the lead story in Yahoo today: Stocks shake off losses after S&P 500's worst first half since 1970. Okay, rub it in for clicks!

50/50 managed balanced fund (https://finance.yahoo.com/quote/RLBGX/) benchmark is -9.99 YTD.

Spouse got 1st pension check. Income/Expenses are pretty stable, and the portfolio total is following AA performance benchmark to a great deal.

Still waiting for another leg down in the stock market. Lol, my crystal ball was foggy last month I suppose.

Attachments

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Pretty much more of the same with some improvement in the right direction.

-2.88% YTD. Same ~34/64/2 [-]32/66/2[/-] AA.

32/66/2 AA for Jan-Jul on Portfolio Visualizer was -10.14 [-]10.03[/-]% so I'm pretty happy with -2.88%

Interesting how the deltas vs the benchmark are swinging around... YTD July +7.26 [-]7.15[/-]%, YTD June +8.80%, YTD May +7.49% vs benchmark.

ETA: found a formula error in my spreadsheet.

-2.88% YTD. Same ~34/64/2 [-]32/66/2[/-] AA.

32/66/2 AA for Jan-Jul on Portfolio Visualizer was -10.14 [-]10.03[/-]% so I'm pretty happy with -2.88%

Interesting how the deltas vs the benchmark are swinging around... YTD July +7.26 [-]7.15[/-]%, YTD June +8.80%, YTD May +7.49% vs benchmark.

ETA: found a formula error in my spreadsheet.

-4.66% YTD. ~32/66/2 AA.

32/66/2 AA for Jan-Jun on Portfolio Visualizer was -13.76% so I'm pretty happy with -4.66%

-3.08% YTD. ~32/66/2 AA.

32/66/2 AA for Jan-May on Portfolio Visualizer was -10.57% so I'm pretty happy with -3.08%

Last edited:

Our net worth is up 9.6% YTD. ~3% of that is new money into the pot. Current Asset Allocation today:

57% private real estate (overwhelmingly rental properties)

5% bonds/cash

3% other (gold/silver/plat/digital currencies/stamps/rare liquors)

35% stocks.

57% private real estate (overwhelmingly rental properties)

5% bonds/cash

3% other (gold/silver/plat/digital currencies/stamps/rare liquors)

35% stocks.

Similar threads

- Replies

- 146

- Views

- 7K

- Replies

- 21

- Views

- 835