Originally Posted by mrfeh View Post

Again, there is no financial benefit. If the dividend isn't paid, the value of the stock/fund simply increases.

And if divs are being reinvested, that amounts to nothing more than an additional purchase to keep track of and potentially cause a wash sale (as demonstrated by a lengthy thread a couple months ago on this site).

I get the impression that some folks here don't really understand how dividends work, or that they are somehow magical/free money.

I get the impression you don’t like others having differing opinions. [emoji12] ...

People are free to have opinions,

mrfeh is outlining the

facts. Attacking him in this way isn't helping your case.

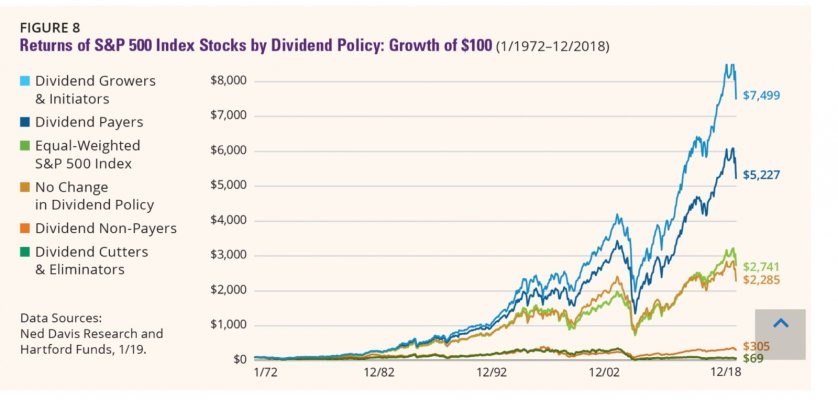

... A company with growing dividends and a reasonable payout ratio is an indication of a healthy company. ...

That's a rear-view mirror look. We need to know about the future. Plenty of once healthy dividend (and non-dividend) payers have gone from healthy to sick, and it isn't clear until the stock has dropped and/or dividends have been cut, to do anything about it. And plenty of once healthy dividend (and non-dividend) payers have gone from sick to healthy - dividends don't have any special value here. If you believe they do,

show some evidence of how an investor can take advantage of this with a diversified portfolio (not a handful of stocks).

... Reinvesting dividends is a good way to dollar cost average into additional shares. ....

No, it's an awful way to do it.

If the company did not distribute the dividend, it would be retained in the stock price. So there would be no need to go through the song/dance of distributing it, just to "reinvest it", and maybe pay taxes on that distribution. Without a dividend distribution, it was

already invested, there is zero need to "re-invest" it. And retaining happens 365 days a year, better than dollar cost averaging once quarter.

Dividends are a way of taking some off the top, without having to sell in a down market.

This is another red-herring. In a balanced portfolio, the fixed income side will handle that. There is rarely ever a case where stocks must be sold when they are down.

... If you don’t like dividend stocks, then avoid them. I personally like them. It’s nice having a regular paycheck in retirement.

I don't avoid them - I take them in my broad based stock funds in the ratio they are represented. They are part of the market, I'm not going to discriminate. Though I would prefer that none of them paid a dividend, but that's not up to me.

All this talk about stocks that have paid a steady/growing dividend for 20 years. If you go back 20 years, the stocks that fit that category

at the time (all that matters for stock picking w/o a crystal ball) did not outperform the market. Because the past was/is not a good indicator of future performance, and div payers tend to put you into a less diversified portfolio.

-ERD50