Closet_Gamer

Thinks s/he gets paid by the post

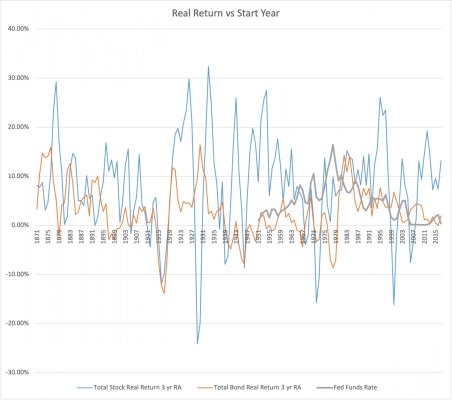

This is a thoughtful article on the relative risk/return of holding bonds vs. equities during periods of extended rate hikes.

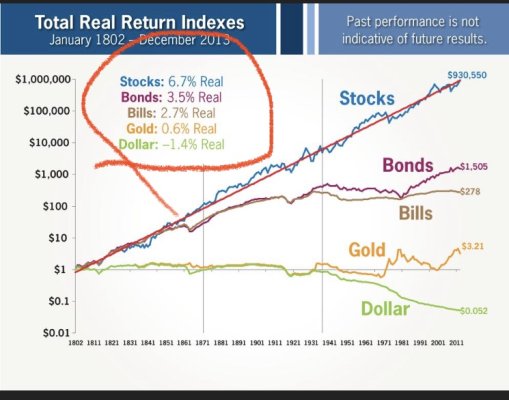

Basic gist is that rates tend to depress the performance of other asset catgories and the risk/return of holding bonds is actually better than most alternatives during rate hiking cycles, perhaps even superior to equities.

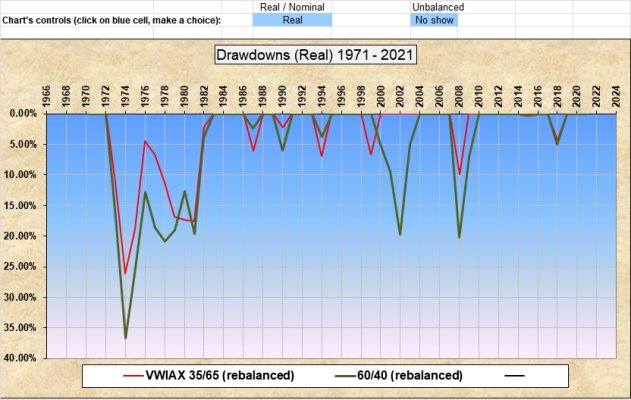

AA devotees will recognise the implicit rebalancing opportunity this suggests.

Active investors will recognise the idea that perhaps its time to move to cash and await the crunch.

I'm not advocating for any of it, just wanted to pass along an interesting read.

https://mailchi.mp/verdadcap/risk-reward-in-a-hiking-cycle?e=6a3b6a5c9b

Basic gist is that rates tend to depress the performance of other asset catgories and the risk/return of holding bonds is actually better than most alternatives during rate hiking cycles, perhaps even superior to equities.

AA devotees will recognise the implicit rebalancing opportunity this suggests.

Active investors will recognise the idea that perhaps its time to move to cash and await the crunch.

I'm not advocating for any of it, just wanted to pass along an interesting read.

https://mailchi.mp/verdadcap/risk-reward-in-a-hiking-cycle?e=6a3b6a5c9b