street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,591

I'm assigned an adviser and she calls every now and then. I pay nothing for her advise and will help me with transactions, advise etc. with no fees, no charges.

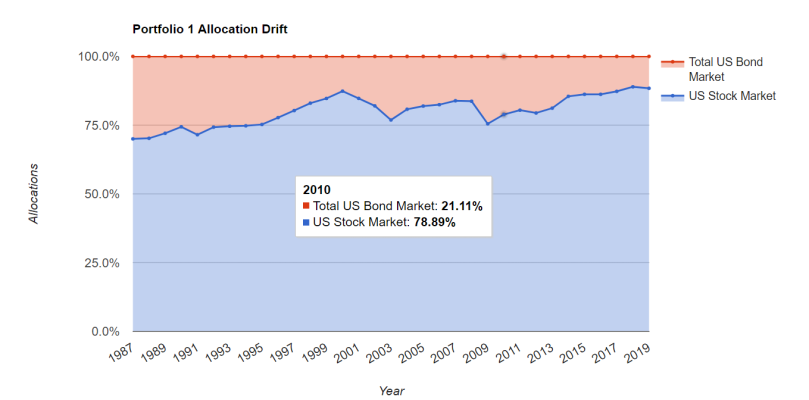

She told me my equity funds have increased 10% from my original plan over the last three years. So on this one portfolio I'm 73/27 ratio. She was wondering if I wanted to rebalance and if not if I want a automatic rebalance if it gets to high and want to stay in my perimeters.

My question is this. Would it be a wise idea for an automatic rebalance of my account? If I want 70% equities it would have to hit 75% before it would automatically rebalance. I also plan never to have too use this money so I want it to grow if at all possible.

What is your thoughts?

She told me my equity funds have increased 10% from my original plan over the last three years. So on this one portfolio I'm 73/27 ratio. She was wondering if I wanted to rebalance and if not if I want a automatic rebalance if it gets to high and want to stay in my perimeters.

My question is this. Would it be a wise idea for an automatic rebalance of my account? If I want 70% equities it would have to hit 75% before it would automatically rebalance. I also plan never to have too use this money so I want it to grow if at all possible.

What is your thoughts?