In short, I'm 42 and single, have a paid off condo, appx $1.5M in cash and another $400K in 401K and I'm just about ready to exit corporate america..maybe for good. I really see my self easing into a second career of my choosing and doing something I enjoy; so, I do expect some form of income stream to kick in at some point in the future. But, for some interim period, I will live off of what I have accrued and would love to hear some ideas on income investments I've mostly been an equity investor to date and would consider myself a newbie when it comes to strategies for producing passive income.

I've mostly been an equity investor to date and would consider myself a newbie when it comes to strategies for producing passive income.

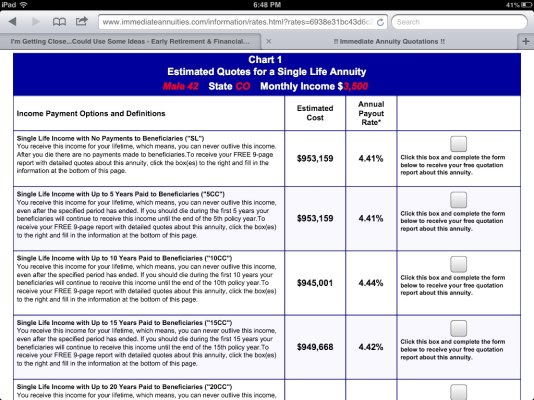

I'd like to have $3,500 a month ($42K) cash to live with and I'm thinking that this is achievable; but, how to structure the mix of investments to get there is a bit daunting in this macroeconomic climate.

I'd love to hear ideas that I can go research..

Thanks,

Chris.

I'd like to have $3,500 a month ($42K) cash to live with and I'm thinking that this is achievable; but, how to structure the mix of investments to get there is a bit daunting in this macroeconomic climate.

I'd love to hear ideas that I can go research..

Thanks,

Chris.