Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We have put a lot of stuff on a credit card with 2% travel bonus rewards while building our house. No time to travel so it just keeps piling up.

Is there a point where you would get concerned? This is Capital One Venture.

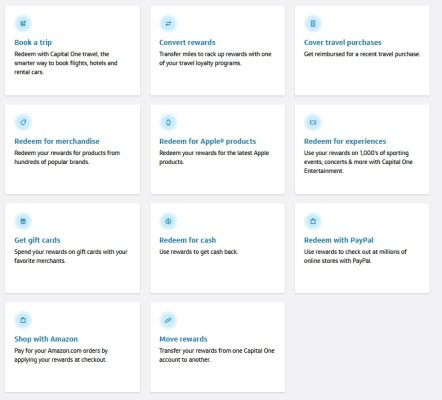

I think we can get Amazon gift cards or cash at some reduced amount but I was always holding out for the 100% reimbursement of hotels and airfare.

But we are talking many thousands now in there.

Is there a point where you would get concerned? This is Capital One Venture.

I think we can get Amazon gift cards or cash at some reduced amount but I was always holding out for the 100% reimbursement of hotels and airfare.

But we are talking many thousands now in there.