NotMyFault

Recycles dryer sheets

- Joined

- Jun 29, 2012

- Messages

- 91

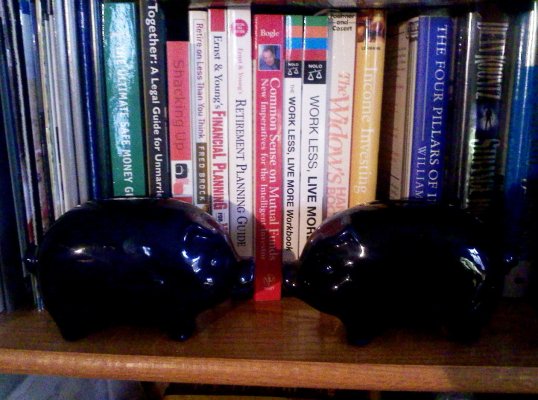

In my early twenties I was a spendthrift. I had college debt, credit card debt, drifting between part time jobs and spending my money and time in bars. Then I met a girl. She was very conservative and a big time saver. She showed me that I was on the fast train nowhere and convinced me to start paying off my debts and get a real job. After a few years of living on pasta and grilled cheese sandwiches I was at a positive net worth. If you never lived the train wreck life you probably do not know how liberating it is to actually have money in the bank. Going from "If my car breaks down what will I do?" To "my transmission went out I will just write a check for that and still have money in the emergency fund" is an incredible experience. From that moment on I realized money=freedom from many worries and having more stuff was not a source of happiness but a burden. Since then I have been a LBYM convert. Since then I have tried to convert others but no one wants to deprive themselves now for a better tomorrow. It took about 6 years to go from below 0 net worth to owning a house. She waited another 4 to make sure what she taught me stuck then she agreed that I was acceptable husband material and married me.

So much for my secret identity, if any of our close friends or relatives reads this they will know exactly who I am.

That's my story. Now when I see people spending more than they make I say there but for the grace of god go I. It was really a close call.

Thanks

NMF

So much for my secret identity, if any of our close friends or relatives reads this they will know exactly who I am.

That's my story. Now when I see people spending more than they make I say there but for the grace of god go I. It was really a close call.

Thanks

NMF