TheHill.com - Deficit grew by $181 billion in July

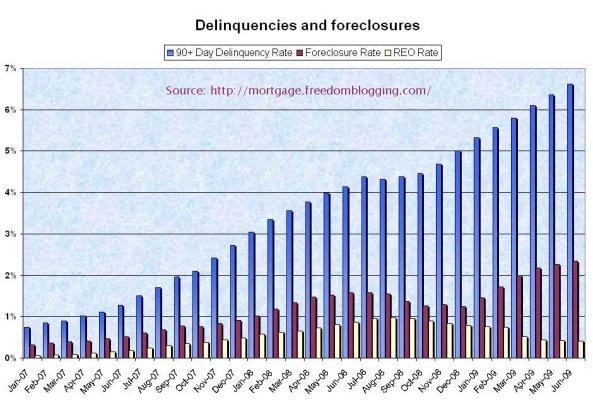

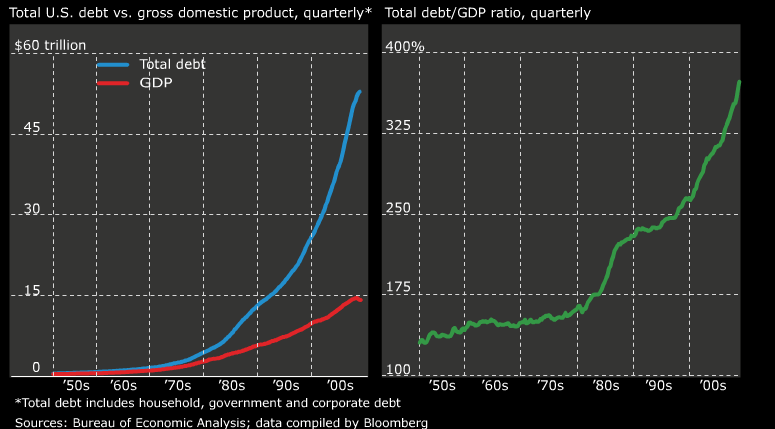

For a macro view of the deflationary situation, the current budget deficit ytd is about 1.2 trillion. 529 billion of that increased is caused by increased government spending, primarily giving Freddie Mac and Fannie May funds to give to the Chinese government to keep the bonds from blowing up. Tax revenues meanwhile fell by 350 billion of which 100 billion is stimulus money from tax reductions. That leaves about 250 billion of tax shortfall from a government assume a 40 percent tax rate and you get a reduction of 600 billion of income, despite the federal goverment spending an additional 529 billion. You can mulitply this problem across 50 states as well.

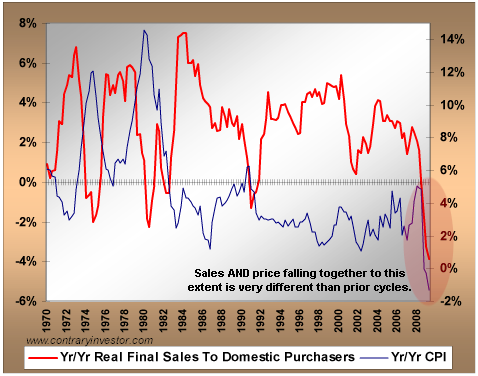

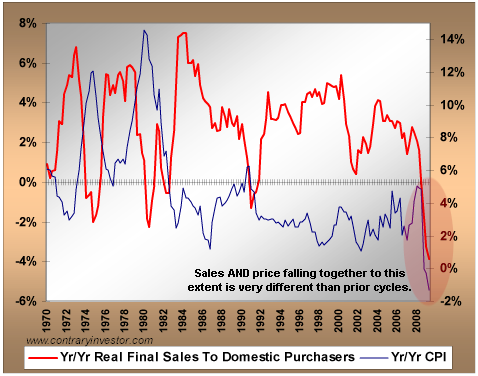

There simply is no view in sight yet of any inflation, indeed I contend deflation is beginning to accelerate. With the tax cuts that are sure to pass this fall (you can't keep spending more and getting in less forever else the Feds will go belly up as well), you'll see economic activity get crushed. Nothing appears in sight that is going to prevent this catastrophe. The Fed surely sees this problem which are why short term rates are still near zero.