Why don't we stick to PPACA, healthcare and how to deal with it, and leave that other stuff for another discussion.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PPACA, Obamacare and General Comments

- Thread starter utrecht

- Start date

Why don't we stick to PPACA, healthcare and how to deal with it, and leave that other stuff for another discussion.

Ooops. Deleted. Thought it was informational, not political but definitely off topic.

You would think so. I assume you have a policy that required medical underwriting, so it seems likely that the risk pool you are in is probably more healthy than the one in the exchange will be. On the other hand, there is no subsidy for your policy, so Anthem may not be able to price it below the subsidized rate.

BTW, Anthem is part of Well Point (WLP).

Thanks FIRE'D. Yes, had to go thru underwriting. Keep in mind that since there will be no underwriting due to automatic acceptance for any of them, the health status of all the pools may change.

Heck, I don't even know if they will have "pools" within the levels. Anyone have any idea how the classifications will work within the levels or is everyone pooled together at the level they apply for?

We don't qualify for a subsidy, have no way to get below that cutoff so it's a non-event for us or perhaps I should say an expensive event.

Just tried this calculator from Covered California..and the rates are significantly lower than the other calculators. So now I'm a bit confused.

http://www.coveredca.com/calculating_the_cost.html

Last edited:

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

Thanks FIRE'D. Yes, had to go thru underwriting. Keep in mind that since there will be no underwriting due to automatic acceptance for any of them, the health status of all the pools may change.

Heck, I don't even know if they will have "pools" within the levels. Anyone have any idea how the classifications will work within the levels or is everyone pooled together at the level they apply for?

We don't qualify for a subsidy, have no way to get below that cutoff so it's a non-event for us or perhaps I should say an expensive event.

Just tried this calculator from Covered California..and the rates are significantly lower than the other calculators. So now I'm a bit confused.

http://www.coveredca.com/calculating_the_cost.html

Thanks for the link. Every calculator that comes out seems to be a little better. Mine pegged out at $393 for a 49 yr. old. My plan is more closer to a bronze so I would guess the premium to be closer to $300. About a 350% increase for me, but better than 600% a few months ago. I have to assume my state will be a little cheaper than California. Although our legislatures refused to take federal money and expand Medicare. Local paper speculated this could lead to higher premiums to help pay for all the hospital charge offs from Medicare not expanding.

M Paquette

Moderator Emeritus

Heck, I don't even know if they will have "pools" within the levels. Anyone have any idea how the classifications will work within the levels or is everyone pooled together at the level they apply for?

The rules require issuers to treat all of their non-grandfathered business in the individual market and the small group market, respectively, as a single risk pool.

PHS Act section 2701 only allows non-grandfathered health insurance issuers in the individual and small group markets to vary premiums based on the following factors beginning in 2014: (1) whether the plan or coverage applies to an individual or family; (2) geographic rating area; (3) age, limited to a variation of 3:1 for adults; and (4) tobacco use, limited to a variation of 1.5:1.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

So if we sell our house and live off the proceeds for a number of years, and we either stop our business income or what we earn gets dispersed between business expenses and retirement contributions, then our taxable income might be pretty low in future years.

The calculators show us on Medicaid under that scenario. That is pretty odd there is no asset test.

What is it like to be on Medicaid? Is that something most doctors and hospitals accept? Is it Medicaid or no subsidy at all for us if our taxable income is low enough?

The calculators show us on Medicaid under that scenario. That is pretty odd there is no asset test.

What is it like to be on Medicaid? Is that something most doctors and hospitals accept? Is it Medicaid or no subsidy at all for us if our taxable income is low enough?

How are they getting the health insurance now, are they uninsured, or their current employer will drop health insurance without increase in compensation after Jan 2014?I'm not worried about loosing my health care at the moment. I am worried about the "cost of premiums" for what I consider low to high middle America. I don't see how a couple making $70,000 per household can easily afford an $18,000 net of tax expense on the exchanges if that is their only choice.

travelover

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 31, 2007

- Messages

- 14,328

...........

The calculators show us on Medicaid under that scenario. That is pretty odd there is no asset test...........

In Michigan there is definitely an assets test. I'd check further for you state.

Htown Harry

Thinks s/he gets paid by the post

- Joined

- May 13, 2007

- Messages

- 1,525

So if we sell our house and live off the proceeds for a number of years, and we either stop our business income or what we earn gets dispersed between business expenses and retirement contributions, then our taxable income might be pretty low in future years.

The calculators show us on Medicaid under that scenario. That is pretty odd there is no asset test.

What is it like to be on Medicaid? Is that something most doctors and hospitals accept? Is it Medicaid or no subsidy at all for us if our taxable income is low enough?

Careful on that assumption of business expenses, DLDS. The Modified Adjusted Gross Income calculation may trip you up.

Section 62(a) is the IRS regulation describing the "above the line" deductions that are calculated before AGI is figured, i.e. those seen on the first page of form 1040. The full list is found here:Internal Revenue Code, §36B(d)(2),

‘‘(d) TERMS RELATING TO INCOME AND FAMILIES.—For purposes

of this section—

‘‘(2) HOUSEHOLD INCOME.—

‘‘(B) MODIFIED GROSS INCOME.—The term ‘modified

gross income’ means gross income—

‘‘(i) decreased by the amount of any deduction

allowable under paragraph (1), (3), (4), or (10) of section

62(a),

‘‘(ii) increased by the amount of interest received

or accrued during the taxable year which is exempt

from tax imposed by this chapter, and

‘‘(iii) determined without regard to sections 911,

931, and 933.

Above-the-line deduction - Wikipedia, the free encyclopedia

Paragraphs 1, 3, 4 and 10 are:

- (1) TRADE AND BUSINESS DEDUCTIONS.--The deductions allowed by this chapter (other than by part VII of this subchapter) which are attributable to a trade or business carried on by the taxpayer, if such trade or business does not consist of the performance of services by the taxpayer as an employee.

- Losses from sale or exchange of property

- Deductions attributable to rents and royalties

- Alimony

How are they getting the health insurance now, are they uninsured, or their current employer will drop health insurance without increase in compensation after Jan 2014?

I don't have an answer for this question. I've read about many families with this income level range that didn't have insurance to begin with due to all the other expenses of their families, i.e. the ones who don't have access to city, state, federal insurance policies which are exempt from ACA anyway.

I seriously doubt employers will increase compensation in addition to the expense they will have with ACA. Either way their cost are going up with (1) offering health care or (2) paying the penalty. Employers may try to make the employee "net neutral" but that is just speculation on my part.

The rules require issuers to treat all of their non-grandfathered business in the individual market and the small group market, respectively, as a single risk pool.

PHS Act section 2701 only allows non-grandfathered health insurance issuers in the individual and small group markets to vary premiums based on the following factors beginning in 2014: (1) whether the plan or coverage applies to an individual or family; (2) geographic rating area; (3) age, limited to a variation of 3:1 for adults; and (4) tobacco use, limited to a variation of 1.5:1.

can anyone explain the no. 3 and 4 scenarios as how they would apply to premiums? sorry if I am in this is the wrong place for this question.

Htown Harry

Thinks s/he gets paid by the post

- Joined

- May 13, 2007

- Messages

- 1,525

PHS Act section 2701 only allows non-grandfathered health insurance issuers in the individual and small group markets to vary premiums based on the following factors beginning in 2014: (1) whether the plan or coverage applies to an individual or family; (2) geographic rating area; (3) age, limited to a variation of 3:1 for adults; and (4) tobacco use, limited to a variation of 1.5:1.

can anyone explain the no. 3 and 4 scenarios as how they would apply to premiums? sorry if I am in this is the wrong place for this question.

Frank, see my post #127 for info on #4.

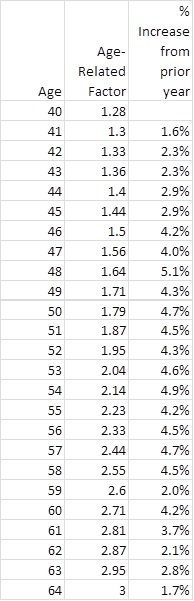

This is the rate age-adjustment table from one of the plans I referenced, showing both 33 and #4 for particular plan. For a given policy and benefit set in a geographic region, they will charge 3 times the premium rate to a 64 y.o. as compared to a 21-25 y.o.

Age and Smoker Factors

Exhibit 12

Age Age Related Smoker

20 0.64 1.00

21 1.00 1.20

22 1.00 1.20

23 1.00 1.20

24 1.00 1.20

25 1.00 1.20

26 1.02 1.20

27 1.05 1.20

28 1.09 1.20

29 1.12 1.20

30 1.14 1.20

31 1.16 1.20

32 1.18 1.20

33 1.20 1.20

34 1.21 1.20

35 1.22 1.20

36 1.23 1.20

37 1.24 1.20

38 1.25 1.20

39 1.26 1.20

40 1.28 1.20

41 1.30 1.20

42 1.33 1.20

43 1.36 1.20

44 1.40 1.20

45 1.44 1.20

46 1.50 1.20

47 1.56 1.20

48 1.64 1.20

49 1.71 1.20

50 1.79 1.20

51 1.87 1.20

52 1.95 1.20

53 2.04 1.20

54 2.14 1.20

55 2.23 1.20

56 2.33 1.20

57 2.44 1.20

58 2.55 1.20

59 2.60 1.20

60 2.71 1.20

61 2.81 1.20

62 2.87 1.20

63 2.95 1.20

64+ 3.00 1.20

dm

Full time employment: Posting here.

We currently are on my wifes group plan from her former job but pay the full premium, $1200 a month. Would we still be able to purchase on the exchanges?

I see on the calculators that they ask if you have insurance thru work.

I see on the calculators that they ask if you have insurance thru work.

Htown Harry

Thinks s/he gets paid by the post

- Joined

- May 13, 2007

- Messages

- 1,525

We currently are on my wifes group plan from her former job but pay the full premium, $1200 a month. Would we still be able to purchase on the exchanges?

I see on the calculators that they ask if you have insurance thru work.

If you are speaking of COBRA benefits, I believe the answer is yes.

The DOL recently (May 8th) put out a new templates for employers to use when notifying employees of eligibilty for COBRA policy continuation benefits at a "qualifying event".

The Department of Labor (DOL) has released 3 model notices as a result of changes under Health Care Reform:

- http://www.dol.gov/ebsa/pdf/FLSAwithplans.pdf for Employers Who Offer a Health Plan to Some or All Employees (must be distributed to current employees no later than October 1, 2013)

- http://www.dol.gov/ebsa/pdf/FLSAwithoutplans.pdffor Employers Who Do Not Offer a Health Plan (must be distributed to current employees no later than October 1, 2013)

- http://www.dol.gov/ebsa/modelelectionnotice.doc(provided to eligible employees and dependents when a qualifying event occurs)

This is included in the last one:

More here: http://www.dol.gov/ebsa/newsroom/tr13-02.html[FONT="]There may be other coverage options for you and your family. When key parts of the health care law take effect, you’ll be able to buy coverage through the Health Insurance Marketplace. In the Marketplace, you could be eligible for a new kind of tax credit that lowers your monthly premiums right away, and you can see what your premium, deductibles, and out-of-pocket costs will be before you make a decision to enroll. Being eligible for COBRA does not limit your eligibility for coverage for a tax credit through the Marketplace. [/FONT]

dm

Full time employment: Posting here.

We are not on cobra. Just allowed to stay on the group plan as long as we pay the full amount of the policy.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

In Michigan there is definitely an assets test. I'd check further for you state.

Apparently the ACA eliminated the asset tests for Medicaid.

"... the new federal health care law bars states from adding asset tests and despite prior experience in Colorado and elsewhere that such tests aren't worth the time or money."

Colorado Republicans want asset test for Medicaid - The Denver Post

Htown Harry

Thinks s/he gets paid by the post

- Joined

- May 13, 2007

- Messages

- 1,525

We are not on cobra. Just allowed to stay on the group plan as long as we pay the full amount of the policy.

This article may be helpful in your situation. It describes what a grandfathered plans is, and why it may be an apples-to-oranges comparison to an exchange policy.

Should you skip Obamacare and keep your old plan? | Reuters

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Careful on that assumption of business expenses, DLDS. The Modified Adjusted Gross Income calculation may trip you up.

We have a couple of actual businesses with expenses like insurance, equipment, and phone costs. Increasing business expenses is one way to lower our MAGI.

Htown Harry

Thinks s/he gets paid by the post

- Joined

- May 13, 2007

- Messages

- 1,525

In post #162, I quoted the age adjustment table in one of the Oregon exchange plans.

Using those numbers, I calculated a percentage change from year-to-year during ER years. It is eye-opening, at least for me.

Now I can see that a HI premium budget based on individual policies should start with an assumed annual premium increase just for the age-rating effects, at around 5% in your 50's. Then add in additional assumed increases for the general inflation in the cost of health care services.

It adds some perspective to the many "my premiums got jacked up 15%" posts I've seen.

Using those numbers, I calculated a percentage change from year-to-year during ER years. It is eye-opening, at least for me.

Now I can see that a HI premium budget based on individual policies should start with an assumed annual premium increase just for the age-rating effects, at around 5% in your 50's. Then add in additional assumed increases for the general inflation in the cost of health care services.

It adds some perspective to the many "my premiums got jacked up 15%" posts I've seen.

Attachments

- Joined

- Oct 13, 2010

- Messages

- 10,763

This article may be helpful in your situation. It describes what a grandfathered plans is, and why it may be an apples-to-oranges comparison to an exchange policy.

Should you skip Obamacare and keep your old plan? | Reuters

eHealthCare analysis agrees with what some of the members on this board have been saying about the price of exchange purchased HI:

Not quite apples to apples, but increase in price by nearly half for something close. Not "affordable" for everyone, but if you can get the subsidy, that pain can be avoided. I just don't envy the guys that get their grandfathered plans closed-out and so are forced into the marketplace and also have MAGI above 400% FPL. Sad day for those guys.Despite the enchancements, plenty of people will look at the new benefits under PPACA and think, "Thanks, but no thanks." Their current policy, grandfathered in, may satisfy their needs and include their doctors in its networks — at a manageable price.

Indeed, many will find it's cheaper to keep their current coverage. Looking at plans in effect today, the online insurance broker eHealthInsurance found that premiums were 47 percent higher and deductibles were 27 percent lower than for individual plans that will incorporate all of PPACA's new rules.

Carrie McLean, consumer health insurance specialist for eHealthInsurance, notes it is not a direct apples-to-apples comparison because many existing plans don't meet basic requirements that all plans will follow as of next January. Also, members who buy coverage through health exchanges may qualify for government subsidies to ease costs.

Nonetheless, average monthly premiums for individuals in plans without the newly required benefits — the closest equivalent to grandfathered plans — were $190 versus $279. Average deductibles for individuals were $2,257 versus $3,079.

Htown Harry

Thinks s/he gets paid by the post

- Joined

- May 13, 2007

- Messages

- 1,525

I am trying to plan against an uncertain work / ER schedule in 2014 and beyond. I may or may not need to purchase insurance through my state exchange in 2014.

This line in an otherwise unremarkable article caught my eye.

Obama set to kick off enrollment blitz amid jitters over health plan - Health Exchange - MarketWatch

Is the plan for the exchanges to have an annual enrollment period similar to employer plans, or Medicare? If so, what will be the qualifying events that allow one to sign up for an exchange policy outside that period?

This line in an otherwise unremarkable article caught my eye.

Obama set to kick off enrollment blitz amid jitters over health plan - Health Exchange - MarketWatch

Does anybody know what the reporter means by enrollment "running through" March 2014? Then what?As Obamacare’s main provision requiring all U.S. citizens to have health insurance takes effect Jan. 1, enrollment via exchanges is scheduled to start in October and run through March.

Is the plan for the exchanges to have an annual enrollment period similar to employer plans, or Medicare? If so, what will be the qualifying events that allow one to sign up for an exchange policy outside that period?

Not sure about the March date, first time I've seen it. Haven't seen any rules on how to buy a policy outside of the annual open enrollment period, but I suspect they will be similar to what the Massachusetts exchange uses today, where you can buy into any policy during the year if you satisfy any of a list of qualifying criteria. https://www.mahealthconnector.org/p...imitedEnrollmentNotice/LimitedOEFactSheet.pdf

Still, I'm guessing, and it may also be up to each state to determine the criteria.

Still, I'm guessing, and it may also be up to each state to determine the criteria.

Peter

Full time employment: Posting here.

My understanding is that the first enrollment period is extended through March to increase the chances that people will enroll. After that it will run from the start of October through to early December.

The reason for having an enrollment period is to discourage people from not signing up until they have a heath problem.

Edit: the above applies to Covered California. Don't know if other states are different.

The reason for having an enrollment period is to discourage people from not signing up until they have a heath problem.

Edit: the above applies to Covered California. Don't know if other states are different.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

I am trying to plan against an uncertain work / ER schedule in 2014 and beyond. I may or may not need to purchase insurance through my state exchange in 2014.

This line in an otherwise unremarkable article caught my eye.

Obama set to kick off enrollment blitz amid jitters over health plan - Health Exchange - MarketWatch

Does anybody know what the reporter means by enrollment "running through" March 2014? Then what?

Is the plan for the exchanges to have an annual enrollment period similar to employer plans, or Medicare? If so, what will be the qualifying events that allow one to sign up for an exchange policy outside that period?

I do not know the long term process for enrolling and accessing the exchange. But, I have read a few articles stating that the original enrolling process was extended to march to allow for people unfamiliar with the process to get signed up. We take for granted that people know what to do, but in reality they do not. A survey released last week showed that 42% of Americans did not know the Act was even law. Half of those 42% thought either the Congress repealed it or the Supreme Court denied it becoming law. Of course the other half of those just didn't even really know anything about it all.

Similar threads

- Replies

- 76

- Views

- 4K

- Replies

- 50

- Views

- 7K

- Replies

- 36

- Views

- 4K

- Replies

- 28

- Views

- 2K