Amethyst

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Dec 21, 2008

- Messages

- 12,686

This is a bad time for us to sell, as we are still liable for part-year MD income taxes. If only W2R had waited till January 1st!

This is a bad time for us to sell, as we are still liable for part-year MD income taxes. If only W2R had waited till January 1st!

I hadn't realized that the original W... post was at Dow 14,000. So Dow 28,000 means the resulting debacle will be twice as bad? Sounds more like DEFCON 2 to me

GMTA. I do have a couple of potential heirs, but we are thinking similarly.This 28000 milestone brings back to light something that I’ve been thinking about lately. My portfolio has risen to a point that I didn’t think it would ever get to post retirement, and generates more than an adequate income. And my age has risen to a point where I have less time left to spend the money, and less time to recover from a future downturn.

So why continue the current AA? Even 50/50 presents more risk than reward to me. I have no heirs to leave $ to, so I have no reason to chase a higher $. So I’m not only going to rebalance. I’m going to reconstruct my portfolio into a more than safe AA.

GMTA. I do have a couple of potential heirs, but we are thinking similarly.

So, about a year ago I decided to change my written financial plan to adapt it more to old age, which hopefully is to come to me at some point. Instead of an AA of 45:55 (which worked out nicely for me in 2008-2009), I switched to an equity portion equal to 110 minus my age and I am slowly moving to that AA.

Should be completely moved to 110-age by 2021. I am 71 now, and 42:58 so I am not quite there yet.

I thought you were shooting for being the oldest woman alive. If so, what will you do at age 111?

After all these years reading this message board, I still can't figure out what the "W" word is. Would someone be willing to whisper it in my ear?

Dow at 28,000. Is that it?

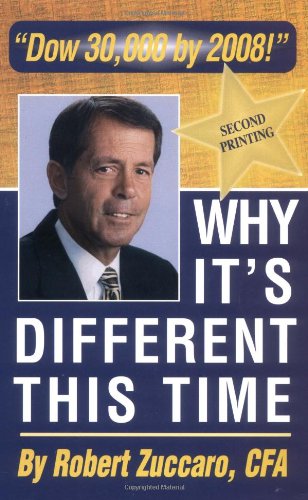

Back in 1999-2000, the following books were published.

Come on, it has been 20 years already. I don't have another 20 years to wait.

Not sure about MD taxes, but when we moved out of NY investment income was only included in the NY return if it has been paid on days were were physically present in the state. There was no part year prorating of investment income.

It's hard to believe, but at closing today the Dow is 28,005 and the S&P is at 3,120 . Seems so amazing.

But before you all "poo poo" my excitement, look at your portfolio balance. In my case, my portfolio is at its all time high (again) today. Also it is 145% of what it was when I retired ten years and six days ago, despite living on it. During that time the CPI only went up a little over 16% so most of this gain is real. During most of those ten years I didn't have SS to lean on like I do now, so who knows what the future may bring.

It would have been nice if I had had two cents to rub together when I was younger, or even middle aged. But then, maybe it's just as well since I did learn to LBYM by not having much.

Well, I just wanted to make all of you fine people smile and feel happy.

Made me look.

Up to new highs even with the bonehead moves I've made recently. (Moved the main bond holding to shorter duration in 2018, selling equities for next year's cash 3 weeks ago.)

Guess it's better to be lucky than smart.

Or what about this?

Dow 30,000 by 2008! Why it's different this time!