Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It feels really good and that is a bit worrisome (if you are a worrier type).

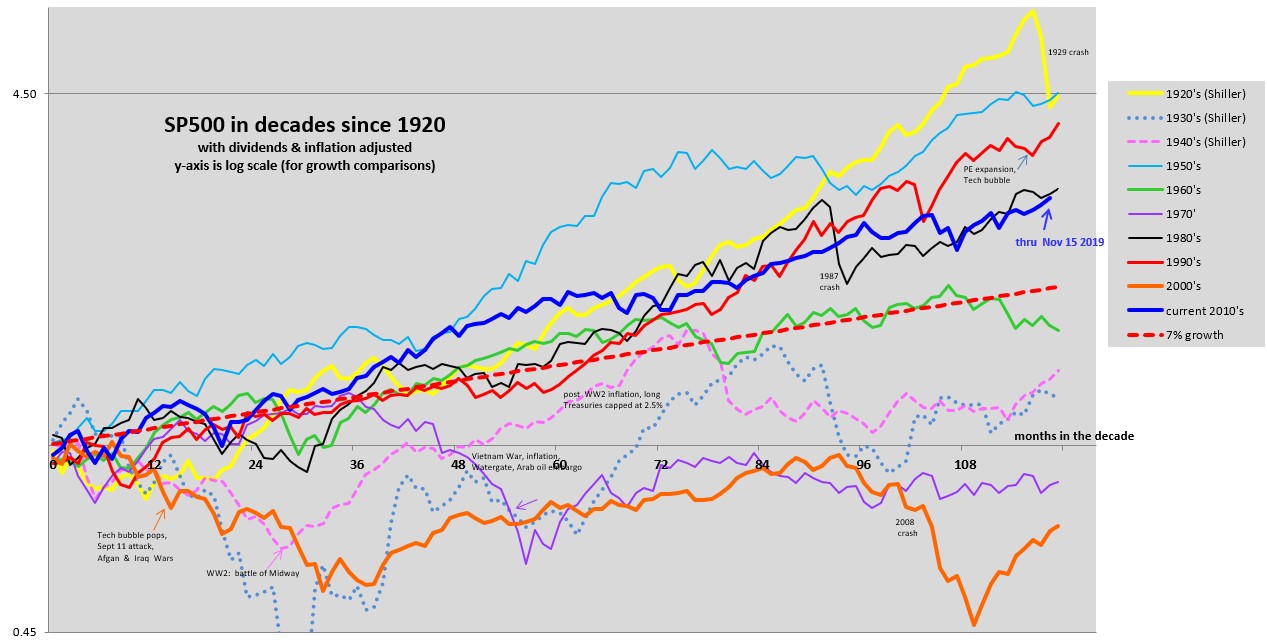

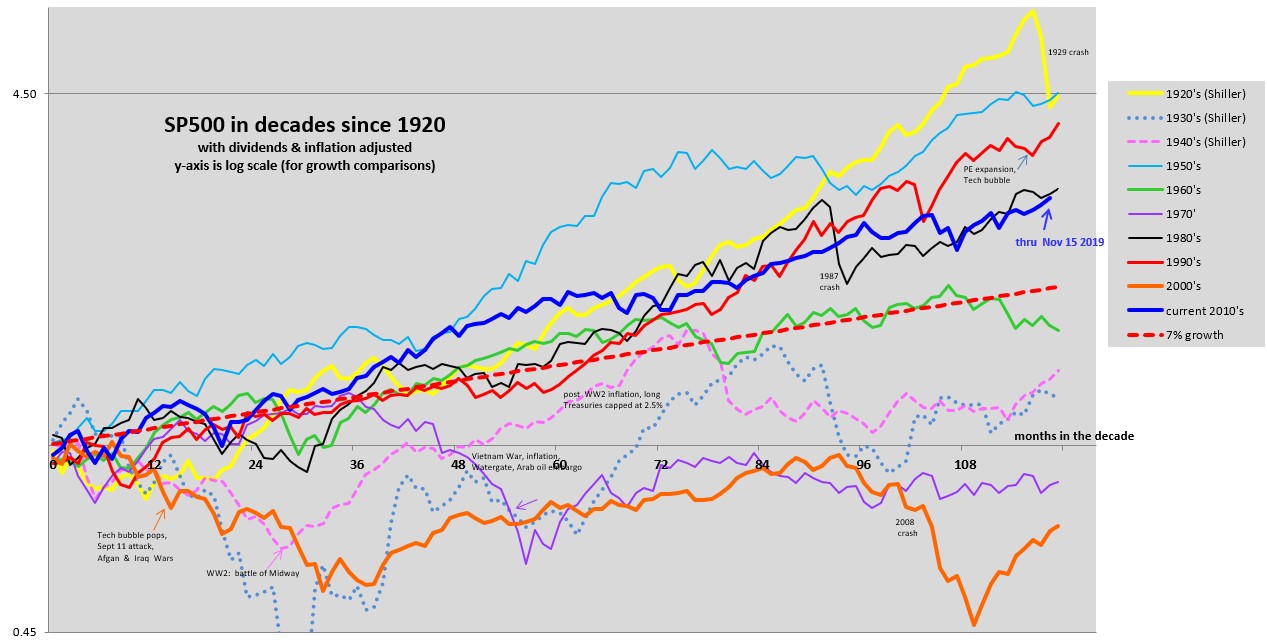

But then the market is not showing a rising slope over the recent few years like happened in periods like the late 1990's and prior to the 1987 crash and the late 1920's. I don't know what will kill this market but it isn't obvious to me.

I updated my decades chart just a few days ago and here it is. It is getting a little hard to read with the addition of some more decades. Note the blue line for our decade has had a fairly constant slope i.e. fairly constant growth rate over recent years.

FWIW, I bought more stocks a week ago. Make golden hay while the sp500 shines.

But then the market is not showing a rising slope over the recent few years like happened in periods like the late 1990's and prior to the 1987 crash and the late 1920's. I don't know what will kill this market but it isn't obvious to me.

I updated my decades chart just a few days ago and here it is. It is getting a little hard to read with the addition of some more decades. Note the blue line for our decade has had a fairly constant slope i.e. fairly constant growth rate over recent years.

FWIW, I bought more stocks a week ago. Make golden hay while the sp500 shines.