Amethyst

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Dec 21, 2008

- Messages

- 12,668

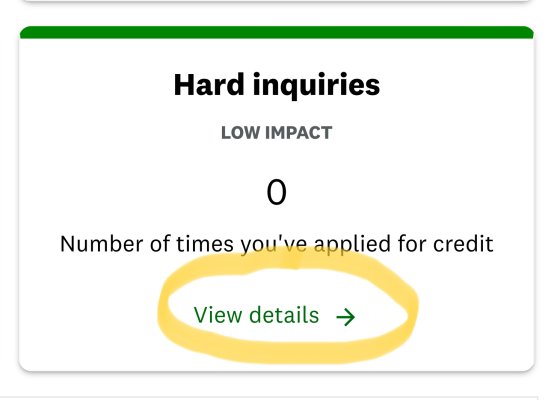

Like many here, I check my credit regularly on Credit Karma, etc.

I was shocked to see that my report reflected three "hard" inquiries, as I haven't so much as opened a new credit card in more than a year.

I don't see anything else amiss on the report, and my score remains high.

How can I fix this? Do I need to freeze my credit?

Thanks,

Amethyst

I was shocked to see that my report reflected three "hard" inquiries, as I haven't so much as opened a new credit card in more than a year.

I don't see anything else amiss on the report, and my score remains high.

How can I fix this? Do I need to freeze my credit?

Thanks,

Amethyst