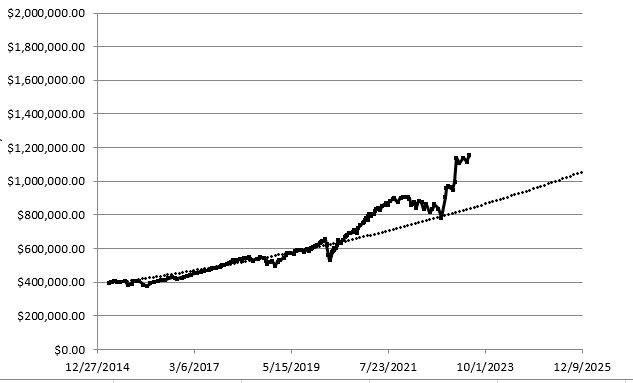

Here's my rundown, although I'm going to do 500K increments, since I'm not in the upper echelons...

1998: Zero. Or, close enough to it. Finally finished digging out from under a bad divorce in 1996 that left me about $30K in the hole.

2010: $500K

2015: $1M

2017: $1.5M (this was helped partially by an inheritance that was in the process of transferring to me, over the course of 2017-2018)

2020: $2.0M (briefly, just before the COVID knock-down. I was back above $2.0M in November 2020)

2021: $2.5M (again, briefly in December, and maybe a couple days into January 2022)

As of this moment (May 2023), I'm hovering around the $2.4M mark. However, rate-of-return wise, I'm worse off than that, as I added about $178K of that myself, between 2022 and so far in 2023.

$3M is my goal number, where if I hit it tomorrow, I'd probably retire. However, I'm starting to think more about going out in April of 2025, when I turn 55. I may not be at $3M by then, but as long as the market doesn't tank, and inflation doesn't blow sky high, I think I'll be in a good place, financially. Plus, even now the idea of only having so many "good" years left, no matter how old I really live to be, is really sinking in, more and more.